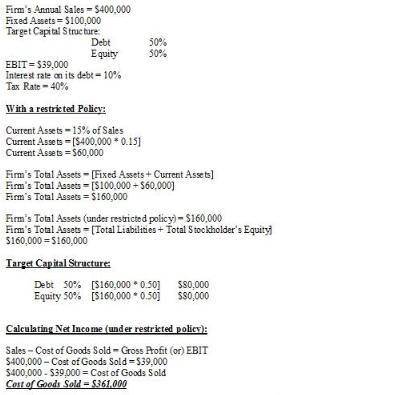

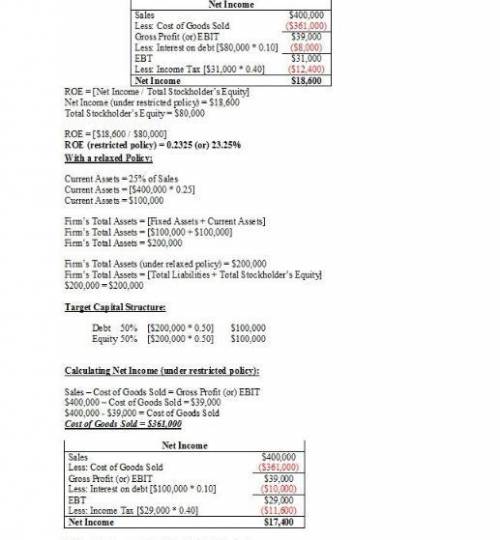

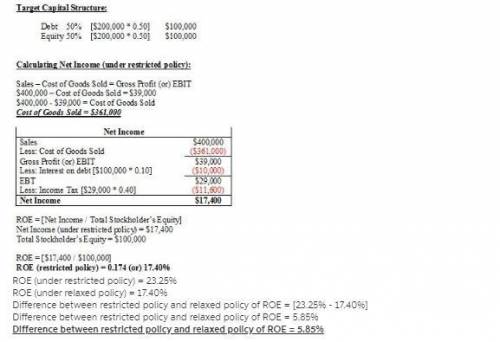

Edwards enterprises follows a moderate current asset investment policy, but it is now considering a change, perhaps to a restricted or maybe to a relaxed policy. the firm's annual sales are $400,000; its fixed assets are $100,000; its target capital structure calls for 50% debt and 50% equity; its ebit is $39,000; the interest rate on its debt is 10%; and its tax rate is 40%. with a restricted policy, current assets will be 15% of sales, while under a relaxed policy they will be 25% of sales. what is the difference in the projected roes between the restricted and relaxed policies?

Answers: 2

Another question on Business

Business, 22.06.2019 01:30

Consider the following limit order book for a share of stock. the last trade in the stock occurred at a price of $50. limit buy orders limit sell orders price shares price shares $49.75 500 $49.80 100 49.70 900 49.85 100 49.65 700 49.90 300 49.60 400 49.95 100 48.65 600 a. if a market buy order for 100 shares comes in, at what price will it be filled? (round your answer to 2 decimal places.) b. at what price would the next market buy order be filled? (round your answer to 2 decimal places.) c. if you were a security dealer, would you want to increase or decrease your inventory of this stock? increase decrease

Answers: 2

Business, 22.06.2019 19:00

Which of the following would cause a shift to the right of the supply curve for gasoline? i. a large increase in the price of public transportation. ii. a large decrease in the price of automobiles. iii. a large reduction in the costs of producing gasoline

Answers: 1

Business, 22.06.2019 19:10

Ancho corp. is an automobile company whose core competency lies in manufacturing petrol- and diesel- based cars. the company realizes that more of its potential customers are switching to electric cars. the r& d department of the company acquires competencies in developing electric cars and launches its first hybrid car, which uses both gas and electricity. in this scenario, ancho is primarilya. leveraging new core competencies to improve current market position. b. redeploying existing core competencies to compete in future markets. c. unlearning existing core competencies to create and compete in markets of the future. d. building new core competencies to protect and extend current market position

Answers: 3

Business, 22.06.2019 19:20

Although appealing to more refined tastes, art as a collectible has not always performed so profitably. during 2003, an auction house sold a sculpture at auction for a price of $10,211,500. unfortunately for the previous owner, he had purchased it in 2000 at a price of $12,177,500. what was his annual rate of return on this sculpture? (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answer as

Answers: 2

You know the right answer?

Edwards enterprises follows a moderate current asset investment policy, but it is now considering a...

Questions

Mathematics, 23.03.2021 03:00

Mathematics, 23.03.2021 03:00

Mathematics, 23.03.2021 03:00

Biology, 23.03.2021 03:00

Mathematics, 23.03.2021 03:00

Chemistry, 23.03.2021 03:00

Biology, 23.03.2021 03:00

Biology, 23.03.2021 03:00

Mathematics, 23.03.2021 03:00

Chemistry, 23.03.2021 03:00