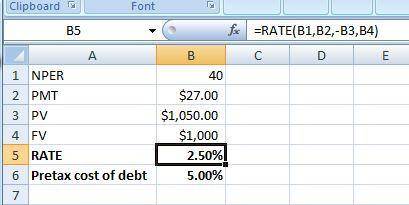

Shanken corp. issued a 20-year, 5.4 percent semiannual bond 3 years ago. the bond currently sells for 105 percent of its face value. the company's tax rate is 24 percent.

a.

what is the pretax cost of debt? (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)

b. what is the aftertax cost of debt? (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)

c. which is more relevant, the pretax or the aftertax cost of debt?

Answers: 1

Another question on Business

Business, 21.06.2019 18:40

Alyssa works for an engineering firm that has been hired to design and supervise the construction of a highway bridge over a major river. the bridge will be a unique design, incorporating complex designs that will likely never be duplicated. how should alyssa deal with designing and overseeing the building of the bridge?

Answers: 3

Business, 22.06.2019 04:40

Dahlia enterprises needs someone to supply it with 127,000 cartons of machine screws per year to support its manufacturing needs over the next five years, and you’ve decided to bid on the contract. it will cost you $940,000 to install the equipment necessary to start production; you’ll depreciate this cost straight-line to zero over the project’s life. you estimate that in five years, this equipment can be salvaged for $77,000. your fixed production costs will be $332,000 per year, and your variable production costs should be $11.00 per carton. you also need an initial investment in net working capital of $82,000. if your tax rate is 30 percent and your required return is 11 percent on your investment, what bid price should you submit? (do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16))

Answers: 3

Business, 22.06.2019 14:00

Wallace company provides the following data for next year: month budgeted sales january $120,000 february 108,000 march 140,000 april 147,000 the gross profit rate is 35% of sales. inventory at the end of december is $29,600 and target ending inventory levels are 10% of next month's sales, stated at cost. what is the amount of purchases budgeted for january?

Answers: 1

You know the right answer?

Shanken corp. issued a 20-year, 5.4 percent semiannual bond 3 years ago. the bond currently sells fo...

Questions

Arts, 27.12.2019 05:31

Geography, 27.12.2019 05:31

Health, 27.12.2019 05:31

Geography, 27.12.2019 05:31

Mathematics, 27.12.2019 05:31

Mathematics, 27.12.2019 05:31

Geography, 27.12.2019 05:31

Biology, 27.12.2019 05:31