Business, 07.12.2019 01:31 hannahdrumsey

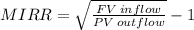

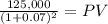

The irr evaluation method assumes that cash flows from the project are reinvested at the same rate equal to the irr. however, in reality the reinvested cash flows may not necessarily generate a return equal to the irr. thus, the modified irr approach makes a more reasonable assumption other than the project’s irr. consider the following situation: green caterpillar garden supplies inc. is analyzing a project that requires an initial investment of $2,500,000. the project’s expected cash flows are: year cash flow year 1 $275,000 year 2 –125,000 year 3 450,000 year 4 450,000 green caterpillar garden supplies inc.’s wacc is 7%, and the project has the same risk as the firm’s average project. calculate this project’s modified internal rate of return (mirr): 21.58% 19.31% -16.50% 23.86% if green caterpillar garden supplies inc.’s managers select projects based on the mirr criterion, they should this independent project. which of the following statements about the relationship between the irr and the mirr is correct? a typical firm’s irr will be equal to its mirr. a typical firm’s irr will be greater than its mirr. a typical firm’s irr will be less than its mirr.

Answers: 2

Another question on Business

Business, 22.06.2019 08:30

What is the key to success in integrating both lethal and nonlethal activities during planning? including stakeholders once a comprehensive operational approach has been determined knowing the commander's decision making processes and "touch points" including stakeholders from the very beginning of the design and planning process including the liaison officers (lnos) in all the decision points?

Answers: 1

Business, 22.06.2019 10:10

conquest, inc. produces a special kind of light-weight, recreational vehicle that has a unique design. it allows the company to follow a cost-plus pricing strategy. it has $9,000,000 of average assets, and the desired profit is a 10% return on assets. assume all products produced are sold. additional data are as follows: sales volume 1000 units per year; variable costs $1000 per unit; fixed costs $4,000,000 per year; using the cost-plus pricing approach, what should be the sales price per unit?

Answers: 2

Business, 22.06.2019 15:30

Uknow what i love about i ask a dumb question it is immediately answered but when i ask a real question it take like an hour to get answered

Answers: 2

You know the right answer?

The irr evaluation method assumes that cash flows from the project are reinvested at the same rate e...

Questions

Mathematics, 27.12.2020 02:50

Mathematics, 27.12.2020 02:50

Mathematics, 27.12.2020 02:50

Computers and Technology, 27.12.2020 02:50

Business, 27.12.2020 02:50

Computers and Technology, 27.12.2020 02:50

Arts, 27.12.2020 03:00

English, 27.12.2020 03:00

Mathematics, 27.12.2020 03:00

![MIRR = \sqrt[n]{\frac{FV \: inflow}{PV \: outflow}} -1](/tpl/images/0407/3052/58ded.png)

![MIRR = \sqrt[4]{\frac{1,268,386.82}{2,609,179.84}} -1](/tpl/images/0407/3052/c94e7.png)