Doug’s custom construction company is considering three new projects, each requiring an equipment investment of $22,000. each project will last for 3 years and produce the following net annual cash flows.

year aa bb cc

1 $7,000 $10,000 $13,000

2 9,000 10,000 12,000

3 12,000 10,000 11,000

total $28,000 $30,000 $36,000

the equipment’s salvage value is zero, and doug uses straight-line depreciation. doug will not accept any project with a cash payback period over 2 years. doug’s required rate of return is 12%. click here to view pv table.

(a)

compute each project’s payback period. (round answers to 2 decimal places, e. g. 15.25.)

aa entry field with correct answer years

bb entry field with correct answer years

cc entry field with correct answer years

which is the most desirable project?

the most desirable project based on payback period is entry field with correct answer project aaproject bbproject cc

which is the least desirable project?

the least desirable project based on payback period is entry field with correct answer project bbproject aaproject cc

(b)

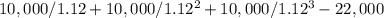

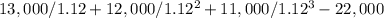

compute the net present value of each project. (enter negative amounts using either a negative sign preceding the number e. g. -45 or parentheses e. g. (45). round final answers to the nearest whole dollar, e. g. 5,275. for calculation purposes, use 5 decimal places as displayed in the factor table provided.)

aa entry field with incorrect answer now contains modified data

bb entry field with incorrect answer now contains modified data

cc entry field with incorrect answer now contains modified data

which is the most desirable project based on net present value?

the most desirable project based on net present value is entry field with correct answer project bbproject aaproject cc.

which is the least desirable project based on net present value?

the least desirable project based on net present value is entry field with correct answer project aaproject ccproject bb.

Answers: 1

Another question on Business

Business, 21.06.2019 22:50

The following data pertains to activity and costs for two months: june july activity level in 10,000 12,000 direct materials $16,000 $ ? fixed factory rent 12,000 ? manufacturing overhead 10,000 ? total cost $38,000 $42,900 assuming that these activity levels are within the relevant range, the manufacturing overhead for july was: a) $10,000 b) $11,700 c) $19,000 d) $9,300

Answers: 2

Business, 22.06.2019 10:30

Trecek corporation incurs research and development costs of $625,000 in 2017, 30 percent of which relate to development activities subsequent to ias 38 criteria having been met that indicate an intangible asset has been created. the newly developed product is brought to market in january 2018 and is expected to generate sales revenue for 10 years. assume that a u.s.–based company is issuing securities to foreign investors who require financial statements prepared in accordance with ifrs. thus, adjustments to convert from u.s. gaap to ifrs must be made. ignore income taxes. required: (a) prepare journal entries for research and development costs for the years ending december 31, 2017, and december 31, 2018, under (1) u.s. gaap and (2) ifrs. (c) prepare the entry(ies) that trecek would make on the december 31, 2017, and december 31, 2018, conversion worksheets to convert u.s. gaap balances to ifrs.

Answers: 1

Business, 22.06.2019 11:00

On analyzing her company’s goods transport route, simone found that they could reduce transport costs by a quarter if they merged different transport routes. what role (job) does simone play at her company? simone is at her company.

Answers: 1

Business, 22.06.2019 18:00

Large public water and sewer companies often become monopolies because they benefit from although the company faces high start-up costs, the firm experiences average production costs as it expands and adds more customers. smaller competitors would experience average costs and would be less

Answers: 1

You know the right answer?

Doug’s custom construction company is considering three new projects, each requiring an equipment in...

Questions

English, 04.05.2021 04:30

Physics, 04.05.2021 04:30

Biology, 04.05.2021 04:30

Mathematics, 04.05.2021 04:30

Mathematics, 04.05.2021 04:30

English, 04.05.2021 04:30

Mathematics, 04.05.2021 04:30

English, 04.05.2021 04:30

Chemistry, 04.05.2021 04:30

Mathematics, 04.05.2021 04:30

Advanced Placement (AP), 04.05.2021 04:30

Mathematics, 04.05.2021 04:30