Business, 09.12.2019 18:31 kayleevilla

The following information is available on a depreciable asset owned by mutual savings bank:

purchase date july 1, year 1

purchase price $73,600

salvage value $10,400

useful life 8 years

depreciation method straight-line

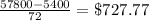

the asset's book value is $57,800 on july 1, year 3. on that date, management determines that the asset's salvage value should be $5,400 rather than the original estimate of $10,400. based on this information, the amount of depreciation expense the company should recognize during the last six months of year 3 would be:

multiple choice

a. $1,750.00

b. $4,366.67

c $2,408.33

d. $2,183.33

e. $2,116.37

Answers: 3

Another question on Business

Business, 21.06.2019 19:40

Which of the following actions is most likely to result in a decrease in the money supply? a. the required reserve ratio for banks is decreased. b. the discount rate on overnight loans is lowered. c. the federal reserve bank buys treasury bonds. d. the government sells a new batch of treasury bonds. 2b2t

Answers: 1

Business, 22.06.2019 01:20

Which of the following statements concerning an organization's strategy is true? a. cost accountants formulate strategy in an organization since they have more inputs about costs. b. businesses usually follow one of two broad strategies: offering a quality product at a high price, or offering a unique product or service priced lower than the competition. c. a good strategy will always overcome poor implementation. d. strategy specifies how an organization matches its own capabilities with the opportunities in the marketplace to accomplish its objectives.

Answers: 1

Business, 22.06.2019 05:50

Nichols inc. manufactures remote controls. currently the company uses a plantminuswide rate for allocating manufacturing overhead. the plant manager is considering switchingminusover to abc costing system and has asked the accounting department to identify the primary production activities and their cost drivers which are as follows: activities cost driver allocation rate material handling number of parts $5 per part assembly labor hours $20 per hour inspection time at inspection station $10 per minute the current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $20 per labor hour. what are the indirect manufacturing costs per remote control assuming an method is used and a batch of 10 remote controls are produced? the batch requires 100 parts, 5 direct manufacturing labor hours, and 3 minutes of inspection time.

Answers: 2

Business, 22.06.2019 09:40

Alpha industries is considering a project with an initial cost of $8 million. the project will produce cash inflows of $1.49 million per year for 8 years. the project has the same risk as the firm. the firm has a pretax cost of debt of 5.61 percent and a cost of equity of 11.27 percent. the debt–equity ratio is .60 and the tax rate is 35 percent. what is the net present value of the project?

Answers: 1

You know the right answer?

The following information is available on a depreciable asset owned by mutual savings bank:

Questions

Chemistry, 10.04.2020 21:35

Computers and Technology, 10.04.2020 21:35

Mathematics, 10.04.2020 21:35

History, 10.04.2020 21:35

Computers and Technology, 10.04.2020 21:35

Biology, 10.04.2020 21:35

Computers and Technology, 10.04.2020 21:35