Business, 09.12.2019 20:31 issagirl05

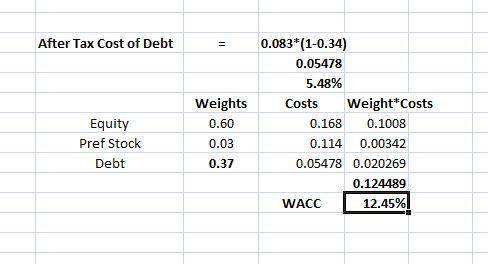

Healthy snacks has a target capital structure of 60 percent common stock, 3 percent preferred stock, and 37 percent debt. its cost of equity is 16.8 percent, the cost of preferred stock is 11.4 percent, and the pretax cost of debt is 8.3 percent. what is the company's wacc if the applicable tax rate is 34 percent? a. 13.29 percentb. 12.61 percentc. 12.34 percentd. 12.45 percente. 12.83 percent

Answers: 1

Another question on Business

Business, 22.06.2019 11:00

What is the advantage of developing criteria for assessing the effectiveness of business products and processes? a. assessment criteria are answers. b.assessment criteria are inexpensive. c.assessment criteria provide you with a list of relevant things to measure. d.assessment criteria provide you with a list of people to contact to learn more about process mentoring.

Answers: 3

Business, 22.06.2019 11:20

Which stage of group development involves members introducing themselves to each other?

Answers: 3

Business, 22.06.2019 19:00

The market demand curve for a popular teen magazine is given by q = 80 - 10p where p is the magazine price in dollars per issue and q is the weekly magazine circulation in units of 10,000. if the circulation is 400,000 per week at the current price, what is the consumer surplus for a teen reader with maximum willingness to pay of $3 per issue?

Answers: 1

You know the right answer?

Healthy snacks has a target capital structure of 60 percent common stock, 3 percent preferred stock,...

Questions

English, 04.10.2019 22:00

History, 04.10.2019 22:00

Computers and Technology, 04.10.2019 22:00

Social Studies, 04.10.2019 22:00

Biology, 04.10.2019 22:00

Physics, 04.10.2019 22:00

Mathematics, 04.10.2019 22:00

Mathematics, 04.10.2019 22:00

Biology, 04.10.2019 22:00

History, 04.10.2019 22:00

Chemistry, 04.10.2019 22:00

Geography, 04.10.2019 22:00

Geography, 04.10.2019 22:00

Mathematics, 04.10.2019 22:00