Business, 09.12.2019 21:31 kayyjayy3106

Suppose you are the purchasing manager for a large chain of restaurants in the united states, and you need to make your semiannual purchase of tea. you pay $1,500,000 for a shipment of tea from an indian tea producer.

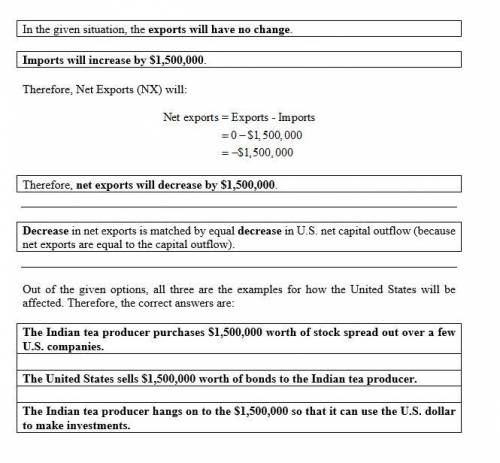

(1) what is the impact of this purchase on us imports and capital flows?

(2) what is the impact of this transaction on us net exports?

how would these same flows be impacted by these transactions?

a. the indian tea producer purchases $1,500,000 worth of stock spread out over a few u. s. companies.

b. the united states sells $1,500,000 worth of bonds to the indian tea producer.

c. the indian tea producer hangs on to the $1,500,000 so that it can use the u. s. dollars to make investments.

Answers: 3

Another question on Business

Business, 21.06.2019 23:00

Employees of dti, inc. worked 1,600 direct labor hours in january and 1,000 direct labor hours in february. dti expects to use 18,000 direct labor hours during the year, and expects to incur $22,500 of worker’s compensation insurance cost for the year. the cash payment for this cost will be paid in april. how much insurance premium should be allocated to products made in january and february?

Answers: 1

Business, 22.06.2019 11:00

Specialization—the division of labor—enhances productivity and efficiency by a) allowing workers to take advantage of existing differences in their abilities and skills. b) avoiding the time loss involved in shifting from one production task to another. c) allowing workers to develop skills by working on one, or a limited number, of tasks. d)all of the means identified in the other answers.

Answers: 2

Business, 22.06.2019 11:30

Buyer henry is going to accept seller shannon's $282,500 counteroffer. when will this counteroffer become a contract. a. counteroffers cannot become contracts b. when henry gives shannon notice of the acceptance c. when henry signs the counteroffer d. when shannon first made the counteroffer

Answers: 3

Business, 22.06.2019 19:50

At the beginning of 2014, winston corporation issued 10% bonds with a face value of $2,000,000. these bonds mature in five years, and interest is paid semiannually on june 30 and december 31. the bonds were sold for $1,852,800 to yield 12%. winston uses a calendar-year reporting period. using the effective-interest method of amortization, what amount of interest expense should be reported for 2014? (round your answer to the nearest dollar.)

Answers: 2

You know the right answer?

Suppose you are the purchasing manager for a large chain of restaurants in the united states, and yo...

Questions

Geography, 22.09.2019 12:30

Mathematics, 22.09.2019 12:30

Spanish, 22.09.2019 12:30

Physics, 22.09.2019 12:30

Social Studies, 22.09.2019 12:30

Mathematics, 22.09.2019 12:30

Mathematics, 22.09.2019 12:30

Mathematics, 22.09.2019 12:30

Mathematics, 22.09.2019 12:30

Social Studies, 22.09.2019 12:30