Business, 11.12.2019 03:31 JavyHart9695

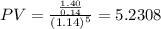

Bc 'n d just paid its annual dividend of $.60 a share. the projected dividends for the next five years are $.30, $.50, $.75, $1.00, and $1.20, respectively. after that time, the dividends will be held constant at $1.40 per share. what is this stock worth today at a discount rate of 14 percent

Answers: 3

Another question on Business

Business, 21.06.2019 22:30

True or false: on january 1, year one, the epstein corporation buys a plot of land with a four-story office building. the company believes the building is worth $1.9 million and has an estimated life of twenty years (with no anticipated residual value). the straight-line method is used. the land has an assessed value of $100,000. because the seller was interested in a quick sale, epstein was able to buy this land and building for $1.7 million. depreciation expense to be recognized in year one is $80,750.

Answers: 3

Business, 22.06.2019 09:50

Is exploiting a distinctive competence or improving efficiency for competitive advantage. (a) cooptation (b) coalition (c) competitive intelligence (d) competitive aggression (e) smoothing

Answers: 1

Business, 22.06.2019 17:00

Serious question, which is preferred in a business? pp or poopoo?

Answers: 1

Business, 22.06.2019 21:00

The purpose of the transportation approach for location analysis is to minimize which of the following? a. total costsb. total fixed costsc. the number of shipmentsd. total shipping costse. total variable costs

Answers: 1

You know the right answer?

Bc 'n d just paid its annual dividend of $.60 a share. the projected dividends for the next five yea...

Questions

Mathematics, 31.01.2020 12:44

Mathematics, 31.01.2020 12:44

Mathematics, 31.01.2020 12:44

Mathematics, 31.01.2020 12:45

Mathematics, 31.01.2020 12:45

Health, 31.01.2020 12:45

Social Studies, 31.01.2020 12:45

Biology, 31.01.2020 12:45

History, 31.01.2020 12:45

Physics, 31.01.2020 12:45