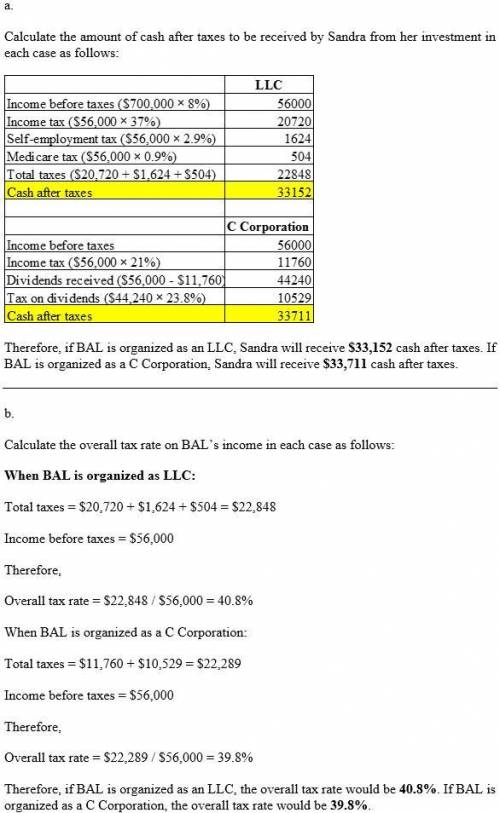

Sandra would like to organize bal as either an llc (taxed as a sole proprietorship) or a c corporation. in either form, the entity is expected to generate an 7 percent annual before-tax return on a $600,000 investment. sandra’s marginal income tax rate is 37 percent and her tax rate on dividends and capital gains is 23.8 percent (including the 3.8 percent net investment income tax). if sandra organizes bal as an llc, she will be required to pay an additional 2.9 percent for self-employment tax and an additional 0.9 percent for the additional medicare tax. bal’s income is not qualified business income (qbi) so sandra is not allowed to claim the qbi deduction. assume that bal will distribute all of its after-tax earnings every year as a dividend if it is formed as a c corporation. (round your intermediate computations to the nearest whole dollar amount.)

a. how much cash after taxes would sandra receive from her investment in the first year if bal is organized as either an llc or a c corporation?

Answers: 1

Another question on Business

Business, 21.06.2019 21:50

You have $22,000 to invest in a stock portfolio. your choices are stock x with an expected return of 11 percent and stock y with an expected return of 13 percent. if your goal is to create a portfolio with an expected return of 11.74 percent, how much money will you invest in stock x? in stock y?

Answers: 2

Business, 22.06.2019 03:10

Jackson is preparing for his hearing before the federal communications commission (fcc) involving a complaint that was filed against him by the fcc regarding the interruption of radio frequency. the order to "cease and desist" using the radio frequency has had a detrimental impact on his business. once the administrative law judge prepares his or her initial order, jackson has no further options. no, jackson can request that the matter be reviewed by an agency board or commission. yes, once the initial order is presented, it's only a matter of time before the order becomes final.

Answers: 3

Business, 22.06.2019 09:00

You speak to a business owner that is taking in almost $2000 in revenue each month. the owner still says that they are having trouble keeping the doors open. how can that be possible? use the terms of revenue, expenses and profit/loss in your answer

Answers: 3

Business, 22.06.2019 11:10

Sam and diane are completing their federal income taxes for the year and have identified the amounts listed here. how much can they rightfully deduct? • agi: $80,000 • medical and dental expenses: $9,000 • state income taxes: $3,500 • mortgage interest: $9,500 • charitable contributions: $1,000.

Answers: 1

You know the right answer?

Sandra would like to organize bal as either an llc (taxed as a sole proprietorship) or a c corporati...

Questions

Mathematics, 30.10.2020 21:10

Mathematics, 30.10.2020 21:10

Mathematics, 30.10.2020 21:10

History, 30.10.2020 21:10

Mathematics, 30.10.2020 21:10

Mathematics, 30.10.2020 21:10

Mathematics, 30.10.2020 21:10

History, 30.10.2020 21:10

Biology, 30.10.2020 21:10

Mathematics, 30.10.2020 21:10

Physics, 30.10.2020 21:10

Mathematics, 30.10.2020 21:10

Physics, 30.10.2020 21:10

Mathematics, 30.10.2020 21:10

Mathematics, 30.10.2020 21:10