Business, 17.12.2019 01:31 Yasminl52899

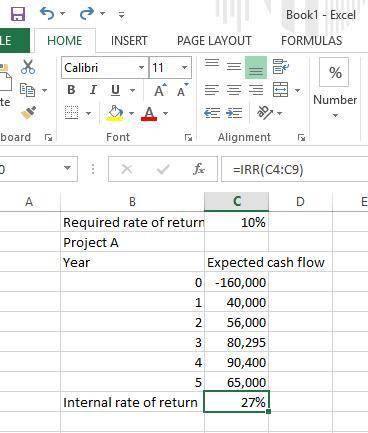

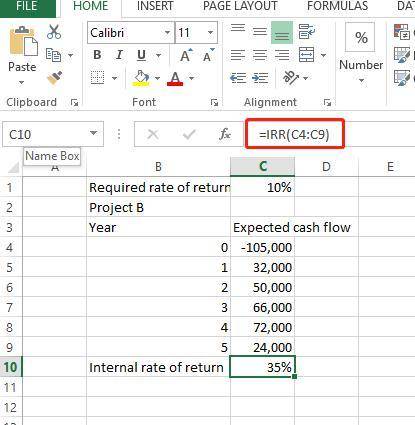

Following is information on two alternative investments being considered by jolee company. the company requires a 10% return from its investments. project a project b initial investment $ (160,000 ) $ (105,000 ) expected net cash flows in year: 1 40,000 32,000 2 56,000 50,000 3 80,295 66,000 4 90,400 72,000 5 65,000 24,000 compute the internal rate of return for each of the projects using excel functions.

Answers: 3

Another question on Business

Business, 21.06.2019 21:40

Torino company has 1,300 shares of $50 par value, 6.0% cumulative and nonparticipating preferred stock and 13,000 shares of $10 par value common stock outstanding. the company paid total cash dividends of $3,500 in its first year of operation. the cash dividend that must be paid to preferred stockholders in the second year before any dividend is paid to common stockholders is:

Answers: 2

Business, 22.06.2019 11:50

After graduation, you plan to work for dynamo corporation for 12 years and then start your own business. you expect to save and deposit $7,500 a year for the first 6 years (t = 1 through t = 6) and $15,000 annually for the following 6 years (t = 7 through t = 12). the first deposit will be made a year from today. in addition, your grandfather just gave you a $32,500 graduation gift which you will deposit immediately (t = 0). if the account earns 9% compounded annually, how much will you have when you start your business 12 years from now?

Answers: 1

Business, 22.06.2019 12:00

Which of the following is one of the advantages primarily associated with a performance appraisal? (a) it protects employees against discrimination on the basis of race. (b) it motivates employees to work on their shortcomings. (c) it encourages employees to play the role of the whistle-blower. (d) it accurately measures the resources of the firm.

Answers: 2

You know the right answer?

Following is information on two alternative investments being considered by jolee company. the compa...

Questions

Computers and Technology, 14.07.2021 01:00

Mathematics, 14.07.2021 01:00

Mathematics, 14.07.2021 01:00