Business, 17.12.2019 03:31 Cutiepie55561

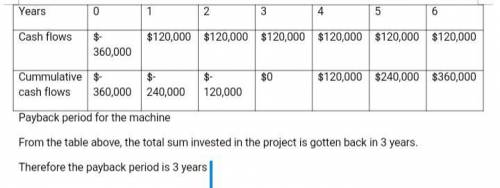

Heather company is considering the acquisition of a machine that costs $360,000. the machine is expected to have a useful life of 6 years, a negligible residual value, an annual cash flow of $120,000, and annual operating income of $83,721.

what is the estimated cash payback period for the machine? a. 5 yearsb. 2.5 yearsc. 4.3 yearsd. 3 years

Answers: 3

Another question on Business

Business, 22.06.2019 11:00

What is the correct percentage of texas teachers charged with ethics violations each year?

Answers: 2

Business, 22.06.2019 20:30

1. what is the lowest balance during this period? 2. lily just received her bank statement below. a. what does the bank think her ending balance is? b. how much more does the bank think lily has? c. what transactions are missing? 3. what is the danger of not balancing your bank account? lily’s bank statement deposits: 2/25 $35 2/26 $20 3/1 $256.32 checks: 2/24 ck #301 $25 2/26 #302 $150 debit card: 2/24 american eagle $75.48 2/25 chick fa la $4.67 2/27 mcdonalds $3.56 2/28 chevron $34.76 withdrawal: 2/27 $40 beginning balance $423.34 deposits $311.32 total debits $333.47 ending balance $401.19

Answers: 1

Business, 23.06.2019 08:30

Blake edwards has done some research and has discovered that economists believe interest rates will rise significantly over the next two years. blake believes that this will lead to fewer homes being sold and fewer jobs in the banking and mortgage industries. this is an example of influencing jobs in the future.

Answers: 1

Business, 23.06.2019 13:20

John and sue smith are a married couple who file a joint income tax return. they have two children, so they claim a total of 4 exemptions (based on calendar year 2015 tax law, a personal exemption of $4,000 per person or dependent can be deducted from total income). in addition, they have legitimate itemized deductions totaling $25,750. their total income from wages is $237,500. what is the couple’s taxable income? $195,750 $221,500 $229,500 $205,750

Answers: 3

You know the right answer?

Heather company is considering the acquisition of a machine that costs $360,000. the machine is expe...

Questions

Mathematics, 18.02.2020 02:24

Mathematics, 18.02.2020 02:27

Computers and Technology, 18.02.2020 02:27