Business, 17.12.2019 05:31 kaiyakunkle

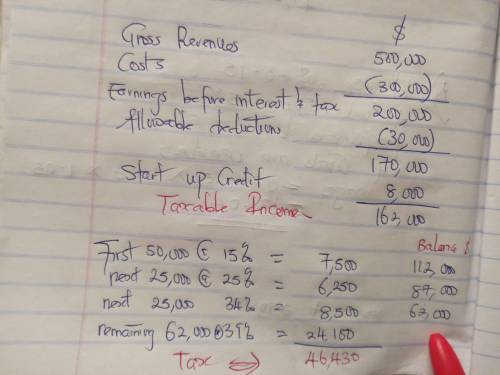

Acompany wants to set up a new office in a country where the corporate tax rate is as follows:

15% of first $50,000 profits, 25% of next $25,000, 34% of next $25,000, and 39% of everything over $100,000.

executives estimate that they will have gross revenues of $500,00, total costs of $300,000, $30,000 in allowable tax deductions, and a one time business start-up credit of $8,000.

what is taxable income for the first year, and how much should the company expect to pay in taxes?

Answers: 3

Another question on Business

Business, 22.06.2019 20:30

When patey pontoons issued 4% bonds on january 1, 2018, with a face amount of $660,000, the market yield for bonds of similar risk and maturity was 5%. the bonds mature december 31, 2021 (4 years). interest is paid semiannually on june 30 and december 31?

Answers: 1

Business, 24.06.2019 03:30

Davis was to attach a scanner to his computer. how will he do this

Answers: 1

Business, 24.06.2019 04:30

What is a velouté? a. brown sauce b. fish stock c. white sauce d. clear broth

Answers: 2

Business, 24.06.2019 11:20

Raybrook inc. has retained earnings of $78,000 at the end of the accounting year. in the next accounting period, it plans to use a part of this earning in purchasing a warehouse. which source of funding is this retained earning a part of? a. external sourceb. internal sourcec. stocksd. preference shares

Answers: 1

You know the right answer?

Acompany wants to set up a new office in a country where the corporate tax rate is as follows:

Questions

Social Studies, 28.07.2019 22:30

Spanish, 28.07.2019 22:30

Mathematics, 28.07.2019 22:30

Mathematics, 28.07.2019 22:30

Mathematics, 28.07.2019 22:30

Mathematics, 28.07.2019 22:30

Spanish, 28.07.2019 22:30

Spanish, 28.07.2019 22:30

English, 28.07.2019 22:30

Physics, 28.07.2019 22:30

Chemistry, 28.07.2019 22:30