Pennewell publishing inc. (pp) is a zero growth company. it currently has zero debt and its earnings before interest and taxes (ebit) are $80,000. pp's current cost of equity is 10%, and its tax rate is 25%. the firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00.

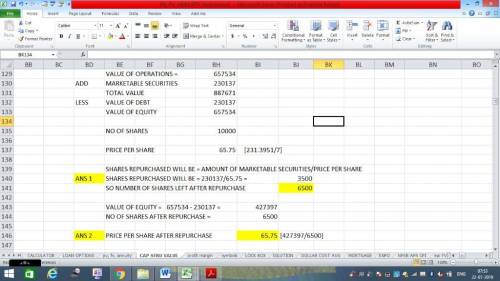

refer to the data for pennewell publishing inc. (pp). assume that pp is considering changing from its original capital structure to a new capital structure with 35% debt and 65% equity. this results in a weighted average cost of capital equal to 9.125% and a new value of operations of $657,534. assume pp raises $230,137 in new debt and purchases t-bills to hold until it makes the stock repurchase. pp then sells the t-bills and uses the proceeds to repurchase stock. how many shares remain after the repurchase, and what is the stock price per share immediately after the repurchase?

remaining shares; p post

a. 7,000; $74.26

b. 6,500; $65.75

c. 7,500; $86.18

d. 6,959; $58.03

e. 6,649; $63.48

Answers: 2

Another question on Business

Business, 21.06.2019 22:50

Which of the following statements is true? a job costing system will have a separate work in process account for each of the major processes. a process costing system will have a single work in process account. a process costing system will have a separate raw materials account for each of the major processes. a process costing system will have a separate work in process account for each of the major processes.

Answers: 3

Business, 21.06.2019 23:30

Actual usage for the year by the marketing department was 70,000 copies and by the operations department was 330,000 copies. if a dual-rate cost-allocation method is used, what amount of copying facility costs will be budgeted for the operations department?

Answers: 2

Business, 22.06.2019 09:40

The wall street journal reported that walmart stores inc. is planning to lay off 2,300 employees at its sam's club warehouse unit. approximately half of the layoffs will be hourly employees (the wall street journal, january 25-26, 2014). suppose the following data represent the percentage of hourly employees laid off for 15 sam's club stores. 55 56 44 43 44 56 60 62 57 45 36 38 50 69 65 (a) compute the mean and median percentage of hourly employees being laid off at these stores. (b) compute the first and third quartiles. (c) compute the range and interquartile range. (d) compute the variance and standard deviation. (e) do the data contain any outliers? (f) based on the sample data, does it appear that walmart is meeting its goal for reducing the number of hourly employees?

Answers: 1

Business, 22.06.2019 20:40

If the ceo of a large, diversified, firm were filling out a fitness report on a division manager (i.e., "grading" the manager), which of the following situations would be likely to cause the manager to receive a better grade? in all cases, assume that other things are held constant.a. the division's basic earning power ratio is above the average of other firms in its industry.b. the division's total assets turnover ratio is below the average for other firms in its industry.c. the division's debt ratio is above the average for other firms in the industry.d. the division's inventory turnover is 6, whereas the average for its competitors is 8.e. the division's dso (days' sales outstanding) is 40, whereas the average for its competitors is 30.

Answers: 1

You know the right answer?

Pennewell publishing inc. (pp) is a zero growth company. it currently has zero debt and its earnings...

Questions

Mathematics, 08.05.2021 18:40

Physics, 08.05.2021 18:40

Mathematics, 08.05.2021 18:40

Mathematics, 08.05.2021 18:40

Mathematics, 08.05.2021 18:40

English, 08.05.2021 18:40

World Languages, 08.05.2021 18:40

Mathematics, 08.05.2021 18:40