On july 1, 2017, crane inc. made two sales.

1. it sold land having a fair value of $915,...

Business, 18.12.2019 03:31 jessieeverett432

On july 1, 2017, crane inc. made two sales.

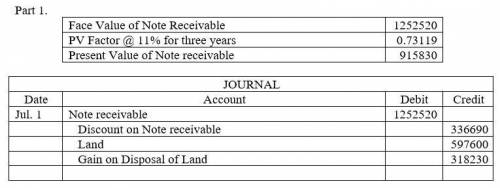

1. it sold land having a fair value of $915,830 in exchange for a 3-year zero-interest-bearing promissory note in the face amount of $1,252,520. the land is carried on agincourt’s books at a cost of $597,600.

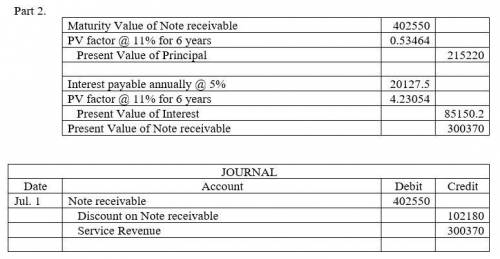

2. it rendered services in exchange for a 5%, 6-year promissory note having a face value of $402,550 (interest payable annually).

crane inc. recently had to pay 8% interest for money that it borrowed from british national bank. the customers in these two transactions have credit ratings that require them to borrow money at 11% interest.

record the two journal entries that should be recorded by crane inc. for the sales transactions above that took place on july 1, 2017. (round present value factor calculations to 5 decimal places, e. g. 1.25124 and final answers to 0 decimal places, e. g. 5,275. if no entry is required, select "no entry" for the account titles and enter 0 for the amounts. credit account titles are automatically indented when the amount is entered. do not indent manually.)

Answers: 1

Another question on Business

Business, 22.06.2019 03:30

Assume that all of thurmond company’s sales are credit sales. it has been the practice of thurmond company to provide for uncollectible accounts expense at the rate of one-half of one percent of net credit sales. for the year 20x1 the company had net credit sales of $2,021,000 and the allowance for doubtful accounts account had a credit balance, before adjustments, of $630 as of december 31, 20x1. during 20x2, the following selected transactions occurred: jan. 20 the account of h. scott, a deceased customer who owed $325, was determined to be uncollectible and was therefore written off. mar. 16 informed that a. nettles, a customer, had been declared bankrupt. his account for $898 was written off. apr. 23 the $906 account of j. kenney & sons was written off as uncollectible. aug. 3 wrote off as uncollectible the $750 account of clarke company. oct. 20 wrote off as uncollectible the $1,130 account of g. michael associates. oct. 27 received a check for $325 from the estate of h. scott. this amount had been written off on january 20 of the current year. dec. 20 cater company paid $7,000 of the $7,500 it owed thurmond company. since cater company was going out of business, the $500 balance it still owed was deemed uncollectible and written off. required: prepare journal entries for the december 31, 20x1, and the seven 20x2 transactions on the work sheets provided at the back of this unit. then answer questions 8 and 9 on the answer sheet. t-accounts are also provided for your use in answering these questions. 8. which one of the following entries should have been made on december 31, 20x1?

Answers: 1

Business, 22.06.2019 11:40

Jamie is saving for a trip to europe. she has an existing savings account that earns 3 percent annual interest and has a current balance of $4,200. jamie doesn’t want to use her current savings for vacation, so she decides to borrow the $1,600 she needs for travel expenses. she will repay the loan in exactly one year. the annual interest rate is 6 percent. a. if jamie were to withdraw the $1,600 from her savings account to finance the trip, how much interest would she forgo? .b. if jamie borrows the $1,600 how much will she pay in interest? c. how much does the trip cost her if she borrows rather than dip into her savings?

Answers: 1

Business, 22.06.2019 19:00

All of the following led to the collapse of the soviet economy except a. a lack of worker incentives. c. inadequate supply of consumer goods. b. a reliance on production quotas. d. the introduction of a market economy.

Answers: 1

Business, 22.06.2019 19:50

Juan's investment portfolio was valued at $125,640 at the beginning of the year. during the year, juan received $603 in interest income and $298 in dividend income. juan also sold shares of stock and realized $1,459 in capital gains. juan's portfolio is valued at $142,608 at the end of the year. all income and realized gains were reinvested. no funds were contributed or withdrawn during the year. what is the amount of income juan must declare this year for income tax purposes?

Answers: 1

You know the right answer?

Questions

Social Studies, 15.01.2020 05:31

History, 15.01.2020 05:31

Arts, 15.01.2020 05:31

History, 15.01.2020 05:31

Physics, 15.01.2020 05:31

Biology, 15.01.2020 05:31

English, 15.01.2020 05:31

Spanish, 15.01.2020 05:31