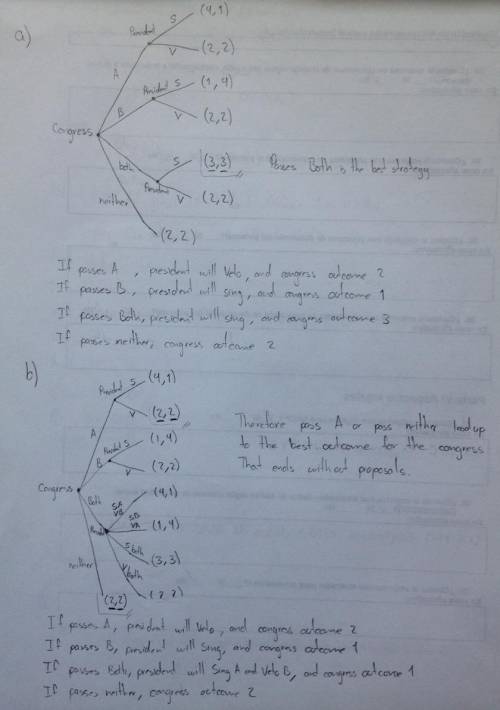

The following two policy proposals are currently being debated in washington, d. c., in order to get the country out of this recession.(a) cut taxes for middle-class american families; and(b) inject capital into major commercial banks. the congress likes proposal (a), and the president likes proposal (b). because the proposals are not mutually exclusive, either or both or neither may become law. thus there are four possible outcomes, and the rankings of the two sides are as follows, where a larger number represents a more favored (a) becomes law41(b) becomes law14both (a) and (b) become law33neither (status quo prevails)22(a) the moves in the game are as follows. first, the congress decides whether to pass a bill and whether it is to contain (a) or (b) or both. then the president decides whether to sign or veto the bill. congress does not have enough votes to override a veto, so the president’s decision will be final. draw a game tree for this game and find the rollback equilibrium.(b) now suppose the rules of the game are changed in only one respect: the president is given the extra power of a line-item veto. that is, if the congress passes a bill containing both (a) and (b), the president may choose not only to sign or veto the bill as a whole, but also to veto just one of the two items. show the new tree and find the rollback equilibrium.

Answers: 2

Another question on Business

Business, 21.06.2019 21:30

Daniel owns 100 shares of abc corporation's common stock. abc uses the fair value option, and recent declines in the firm's credit rating have caused the value of the firm's outstanding bonds payable to drop by 10%. daniel feels this is good news, but he wants to know what you think about the situation. which of the following represents your best response? a : "this situation may be positive for you in that the change in abc's credit standing indicates that the value of the firm's assets is likely increasing. however, the drop in bond value may negate any positive effects on your bottom line, because it means your claim on the firm's assets is simultaneously decreasing." b : "actually, this is bad news all around. the drop in the value of abc's bonds payable means shareholders' claims on the firm's assets have decreased. moreover, abc's declining credit rating means that the firm's assets are probably also dropping in value, thus magnifying your losses even more." c : "on the surface, this seems like good news because it means your claim on the firm's assets has increased. however, the drop in creditworthiness may also indicate that abc's assets are declining in value, thus offsetting any gains associated with the drop in bonds payable." d : "you're right! this is good news because it means that abc's debtholders have a decreased claim on the firm's assets. as a result, the firm's existing shareholders"like you"have seen their claim on the firm's assets increase."

Answers: 2

Business, 21.06.2019 21:30

Afreezer manufacturer might purchase sheets of steel, wiring, shelving, and so forth, as part of its final product. this is an example of what sub-classification of business market?

Answers: 1

Business, 22.06.2019 23:30

Sally has a high-paying management position with a fortune 500 company, but she is tired of working for corporate america. so sally has decided to start a business, and she knows she will be successful as an entrepreneur because entrepreneurs typically

Answers: 3

Business, 23.06.2019 10:20

Global tek plans on increasing its annual dividend by 15 percent a year for the next four years and then decreasing the growth rate to 2.5 percent per year. the company just paid its annual dividend in the amount of $.20 per share. what is the current value of one share of this stock if the required rate of return is 17.4 percent? $1.82 $218 $2.03 $2.71 $3.05

Answers: 1

You know the right answer?

The following two policy proposals are currently being debated in washington, d. c., in order to get...

Questions

Social Studies, 20.03.2021 07:10

Biology, 20.03.2021 07:10

Mathematics, 20.03.2021 07:10

English, 20.03.2021 07:10

History, 20.03.2021 07:10

Physics, 20.03.2021 07:10

Mathematics, 20.03.2021 07:10

Chemistry, 20.03.2021 07:10

Physics, 20.03.2021 07:10

Mathematics, 20.03.2021 07:10

Mathematics, 20.03.2021 07:10

English, 20.03.2021 07:10

Mathematics, 20.03.2021 07:10

Mathematics, 20.03.2021 07:10