Business, 19.12.2019 03:31 tommyaberman

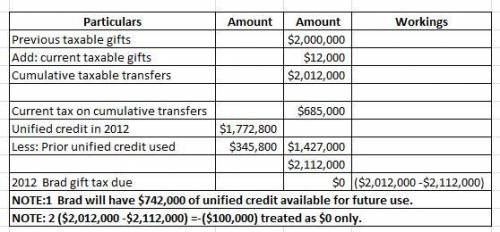

Brad and angelina are a wealthy couple who have three children, fred, bridget, and lisa. two of the three children, fred and bridget, are from brad’s previous marriages. on christmas this year, brad gave each of the three children a cash gift of $6,500, and angelina gave lisa an additional cash gift of $41,000. brad also gave stock worth $54,000 (adjusted basis of $13,500) to the actor’s guild (an "a" charity).

(leave no answer blank. enter zero if applicable.)

a. brad and angelina have chosen to split gifts. calculate brad’s gift tax. assume that angelina has no previous taxable gifts, but brad reported previous taxable gifts of $2 million in 2009 when he used $345,800 of unified credit and paid $435,000 of gift taxes. (reference the tax rate schedule in exhibit 25-1 and the unified credit schedule in exhibit 25-2 to answer this problem.)

Answers: 1

Another question on Business

Business, 22.06.2019 06:40

As a finance manager at allsports communication, charlie worries about the firm's borrowing requirements for the upcoming year. he knows the benefit of estimating allsports' cash disbursements and short-term investment expectations. facing these concerns, a(n) would provide charlie with valuable information by providing a good estimation of whether the firm will need to do short-term borrowing. capital budget cash budget operating budget line item budget

Answers: 3

Business, 22.06.2019 17:00

Aaron corporation, which has only one product, has provided the following data concerning its most recent month of operations: selling price $ 102 units in beginning inventory 0 units produced 4,900 units sold 4,260 units in ending inventory 640 variable costs per unit: direct materials $ 20 direct labor $ 41 variable manufacturing overhead $ 5 variable selling and administrative expense $ 4 fixed costs: fixed manufacturing overhead $ 64,200 fixed selling and administrative expense $ 2,900 the total contribution margin for the month under variable costing is:

Answers: 2

Business, 22.06.2019 20:00

Qwest airlines has implemented a program to recycle all plastic drink cups used on their aircraft. their goal is to generate $7 million by the end of the recycle program's five-year life. each recycled cup can be sold for $0.005 (1/2 cent). a. how many cups must be recycled annually to meet this goal? assume uniform annual plastic cup usage and a 0% interest rate. b. repeat part (a) when the annual interest rate is 12%. c. why is the answer to part (b) less than the answer to part (a)?

Answers: 1

Business, 22.06.2019 22:20

Who owns a renter-occupied apartment? a. the government b. a landlord c. the resident d. a cooperative

Answers: 1

You know the right answer?

Brad and angelina are a wealthy couple who have three children, fred, bridget, and lisa. two of the...

Questions

English, 12.03.2021 04:20

Mathematics, 12.03.2021 04:20

History, 12.03.2021 04:20

Mathematics, 12.03.2021 04:20

History, 12.03.2021 04:20

English, 12.03.2021 04:20

Mathematics, 12.03.2021 04:20

Biology, 12.03.2021 04:20

Mathematics, 12.03.2021 04:20

Mathematics, 12.03.2021 04:20

History, 12.03.2021 04:20

Mathematics, 12.03.2021 04:20

Mathematics, 12.03.2021 04:20