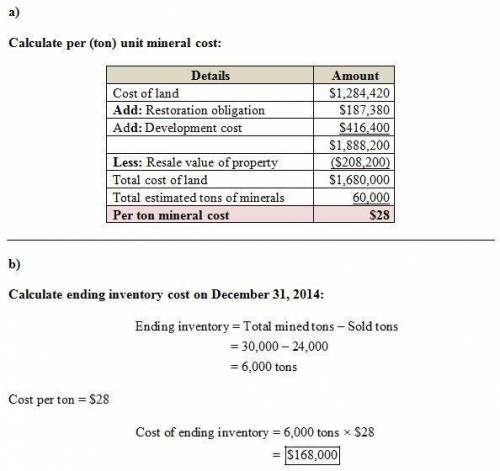

Alcide mining company purchased land on february 1, 2014, at a cost of $1,284,420. it estimated that a total of 60,000 tons of mineral was available for mining. after it has removed all the natural resources, the company will be required to restore the property to its previous state because of strict environmental protection laws. it estimates the fair value of this restoration obligation at $187,380. it believes it will be able to sell the property afterwards for $208,200. it incurred developmental costs of $416,400 before it was able to do any mining. in 2014, resources removed totaled 30,000 tons. the company sold 24,000 tons.

(a) per unit mineral cost.

(b) total material cost of december 31, 2014, inventory

(c) total materials cost in cost of goods sold at december 31, 2014.

Answers: 1

Another question on Business

Business, 22.06.2019 06:50

On january 1, vermont corporation had 40,000 shares of $10 par value common stock issued and outstanding. all 40,000 shares has been issued in a prior period at $20.00 per share. on february 1, vermont purchased 3,750 shares of treasury stock for $24 per share and later sold the treasury shares for $21 per share on march 1. the journal entry to record the purchase of the treasury shares on february 1 would include a credit to treasury stock for $90,000 debit to treasury stock for $90,000 credit to a gain account for $112,500 debit to a loss account for $112,500

Answers: 3

Business, 22.06.2019 14:20

Your uncle borrows $53,000 from the bank at 11 percent interest over the nine-year life of the loan. use appendix d for an approximate answer but calculate your final answer using the formula and financial calculator methods. what equal annual payments must be made to discharge the loan, plus pay the bank its required rate of interest

Answers: 1

Business, 22.06.2019 20:00

Miller mfg. is analyzing a proposed project. the company expects to sell 14,300 units, plus or minus 3 percent. the expected variable cost per unit is $15 and the expected fixed cost is $35,000. the fixed and variable cost estimates are considered accurate within a plus or minus 3 percent range. the depreciation expense is $32,000. the tax rate is 34 percent. the sale price is estimated at $19 a unit, give or take 3 percent. what is the net income under the worst case scenario?

Answers: 2

Business, 22.06.2019 22:10

jackie's snacks sells fudge, caramels, and popcorn. it sold 12,000 units last year. popcorn outsold fudge by a margin of 2 to 1. sales of caramels were the same as sales of popcorn. fixed costs for jackie's snacks are $14,000. additional information follows: product unit sales prices unit variable cost fudge $5.00 $4.00 caramels $8.00 $5.00 popcorn $6.00 $4.50 the breakeven sales volume in units for jackie's snacks is

Answers: 1

You know the right answer?

Alcide mining company purchased land on february 1, 2014, at a cost of $1,284,420. it estimated that...

Questions

Mathematics, 19.10.2020 05:01

English, 19.10.2020 05:01

History, 19.10.2020 05:01

Chemistry, 19.10.2020 05:01

Mathematics, 19.10.2020 05:01

Spanish, 19.10.2020 05:01

Biology, 19.10.2020 05:01

Arts, 19.10.2020 05:01

Spanish, 19.10.2020 05:01