Business, 20.12.2019 01:31 mikaelalcool1

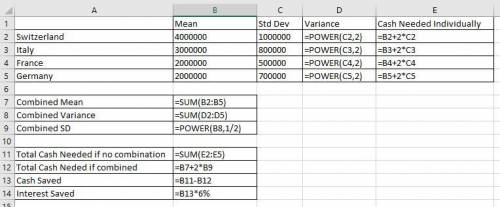

International finance problem set on working capital management1. rossignol co. manufactures and sells skis and snowboards in france, switzerland and italy, and also maintains a corporate account in frankfurt, germany. rossignol has been setting separate operating cash balances in each country at a level equal to expected cash needs plus two standard deviations above those needs, based on a statistical analysis of cash flow volatility. expected operating cash needs and one standard deviation of those needs are below. rossignol’s frankfurt bank suggests that the same level of safety could be maintained if all precautionary balances were combined in a central account at the frankfurt headquarters. a. how much lower would rossignol’s total cash balances be if all precautionary balances were combined? assume cash needs in each country are normally distributed and are independent of each other. b. how much would the company save annually, if financing costs are 6% p. a., from centralizing its cash holdings?

Answers: 3

Another question on Business

Business, 22.06.2019 10:50

The uptowner just paid an annual dividend of $4.12. the company has a policy of increasing the dividend by 2.5 percent annually. you would like to purchase shares of stock in this firm but realize that you will not have the funds to do so for another four years. if you require a rate of return of 16.7 percent, how much will you be willing to pay per share when you can afford to make this investment?

Answers: 3

Business, 22.06.2019 11:10

Sam and diane are completing their federal income taxes for the year and have identified the amounts listed here. how much can they rightfully deduct? • agi: $80,000 • medical and dental expenses: $9,000 • state income taxes: $3,500 • mortgage interest: $9,500 • charitable contributions: $1,000.

Answers: 1

Business, 22.06.2019 19:10

You have just been hired as a brand manager at kelsey-white, an american multinational consumer goods company. recently the firm invested in the development of k-w vision, a series of systems and processes that allow the use of up-to-date data and advanced analytics to drive informed decision making about k-w brands. it is 2018. the system is populated with 3 years of historical data. as brand manager for k-w’s blue laundry detergent, you are tasked to lead the brand's turnaround. use the vision platform to to develop your strategy and grow blue’s market share over the next 4 years.

Answers: 2

You know the right answer?

International finance problem set on working capital management1. rossignol co. manufactures and sel...

Questions

Chemistry, 07.12.2021 06:30

Biology, 07.12.2021 06:30

Mathematics, 07.12.2021 06:30

Mathematics, 07.12.2021 06:30

Social Studies, 07.12.2021 06:30

Chemistry, 07.12.2021 06:40

Mathematics, 07.12.2021 06:40

Mathematics, 07.12.2021 06:40

Chemistry, 07.12.2021 06:40