Business, 20.12.2019 02:31 ortizprecious5183

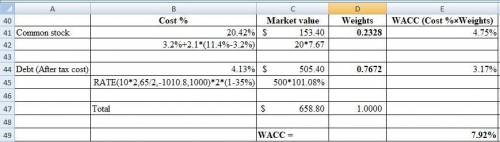

Calculate the wacc for ttt. assume ttt is in the 35% tax bracket. ttt has $500 million face value of debt outstanding. the debt has a price of 101: 08, a coupon of 6 ½ % (coupons are paid semi-annually), and a maturity of 10 years. ttt has 20 million shares of stock outstanding. the shares are currently priced at $7.67. the company pays no dividend, but estimates of the company’s beta are 2.1. the current risk-free rate is 3.2%, and the rate of return on the market portfolio is 11.4%.

Answers: 3

Another question on Business

Business, 22.06.2019 16:30

Why are there so many types of diversion programs for juveniles

Answers: 2

Business, 23.06.2019 03:10

Prepare the operating activities section—indirect method.(lo 4), apthe income statement of paxson company is presented here.paxson companyincome statementfor the year ended november 30, 2014sales revenue $7,600,000cost of goods sold beginning inventory$1,900,000 purchases4,400,000goods available for sale6,300,000 ending inventory1,600,000total cost of goods sold 4,700,000gross profit 2,900,000operating expenses selling expenses450,000 administrative expenses700,0001,150,000net income $1,750,000additional information: prepare the operating activities section—indirect 1. accounts receivable decreased $380,000 during the year, and inventory decreased $300,000.2. prepaid expenses increased $150,000 during the year.3. accounts payable to suppliers of merchandise decreased $350,000 during the year.4. accrued expenses payable decreased $100,000 during the year.5. administrative expenses include depreciation expense of $110,000.instructionsprepare the operating activities section of the statement of cash flows for the year ended november 30, 2014, for paxson company, using the indirect method.net cash provided $1,940,000

Answers: 1

Business, 23.06.2019 08:20

You are a newspaper publisher. you are in the middle of a one-year rental contract for your factory that requires you to pay $500,000 per month, and you have contractual labor obligations of $1 million per month that you can't get out of. you also have a marginal printing cost of $.25 per paper as well as a marginal delivery cost of $.10 per paper. if sales fall by 20 percent from 1 million papers per month to 800,000 papers per month, what happens to the afc per paper?

Answers: 2

Business, 23.06.2019 17:30

Which of the following methods is designed to determine the demographics of a particular target market? primary market research secondary market research diversity marketing differentiated marketing

Answers: 1

You know the right answer?

Calculate the wacc for ttt. assume ttt is in the 35% tax bracket. ttt has $500 million face value of...

Questions

History, 05.01.2020 09:31

Geography, 05.01.2020 09:31

Mathematics, 05.01.2020 09:31

Mathematics, 05.01.2020 09:31

Mathematics, 05.01.2020 09:31

Biology, 05.01.2020 09:31

Mathematics, 05.01.2020 09:31

Mathematics, 05.01.2020 09:31

English, 05.01.2020 09:31