Business, 20.12.2019 05:31 kayla232734

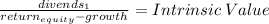

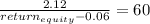

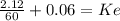

Nch corporation, which markets cleaning chemicals, insecticides and other products, paid dividends of $2.00 per share in 1993 on earnings of $4.00 per share. the book value of equity per share was $40.00, and earnings are expected to grow 6% a year in the long term. the stock has a beta of 0.85, and sells for $60 per share. (the treasury bond rate is 7% how much would the return on equity have to increase to justify the price/book value ratio at which nch sells for currently?

Answers: 1

Another question on Business

Business, 22.06.2019 20:00

Double corporation acquired all of the common stock of simple company for

Answers: 1

Business, 23.06.2019 00:00

The undress company produces a dress that women use to quickly and easily change in public. the company is just over a year old and has been successful through a kickstarter campaign. the undress company has identified a customer segment, but if it wants to reach a larger customer segment market outside of the kickstarter family, what question must it answer?

Answers: 1

You know the right answer?

Nch corporation, which markets cleaning chemicals, insecticides and other products, paid dividends o...

Questions

Mathematics, 29.01.2021 16:40

Social Studies, 29.01.2021 16:40

Advanced Placement (AP), 29.01.2021 16:40

Mathematics, 29.01.2021 16:40

Business, 29.01.2021 16:40

Physics, 29.01.2021 16:40

Mathematics, 29.01.2021 16:40

Mathematics, 29.01.2021 16:40

Mathematics, 29.01.2021 16:40

Mathematics, 29.01.2021 16:40

Chemistry, 29.01.2021 16:40