Business, 20.12.2019 19:31 reddmeans6

When the double-extension approach to the dollar-value lifo inventory method is used, the inventory layer added in the current year is multiplied by an index number.

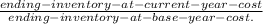

which of the following correctly states how components are used in the calculation of this index number?

a. in the numerator, the average of the ending inventory at base year cost and at current year cost.

b. in the numerator, the ending inventory at current year cost, and, in the denominator, the ending inventory at base year cost.

c. in the numerator, the ending inventory at base year cost, and, the denominator, the ending inventory at current year cost.

d. in the denominator, the average of the ending inventory at base year cost and at current year cost.

Answers: 1

Another question on Business

Business, 21.06.2019 18:20

Which of the following is intended to demonstrate to an employer the importance of cooperating with workers? a. a collective agreement. b. a stock offer. c. a boost in production. d. a work slowdown. 2b2t

Answers: 2

Business, 21.06.2019 20:30

What does the phrase limited liability mean in a corporate context?

Answers: 2

Business, 22.06.2019 01:30

Ben collins plans to buy a house for $166,000. if the real estate in his area is expected to increase in value by 2 percent each year, what will its approximate value be five years from now?

Answers: 1

Business, 22.06.2019 07:40

Xyz corporation has provided the following data concerning manufacturing overhead for july: actual manufacturing overhead incurred $ 69,000 manufacturing overhead applied to work in process $ 79,000 the company's cost of goods sold was $243,000 prior to closing out its manufacturing overhead account. the company closes out its manufacturing overhead account to cost of goods sold. which of the following statements is true? multiple choice manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000

Answers: 1

You know the right answer?

When the double-extension approach to the dollar-value lifo inventory method is used, the inventory...

Questions

English, 20.05.2021 01:00

Spanish, 20.05.2021 01:00

English, 20.05.2021 01:00

History, 20.05.2021 01:00

Mathematics, 20.05.2021 01:00

Computers and Technology, 20.05.2021 01:00

Mathematics, 20.05.2021 01:00

Mathematics, 20.05.2021 01:00

Chemistry, 20.05.2021 01:00

Mathematics, 20.05.2021 01:00