Business, 20.12.2019 21:31 charrsch9909

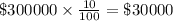

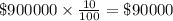

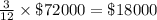

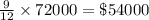

The frank company has issued 10%, fully participating, cumulative preferred stock with a total par value of $300,000 and common stock with a total par value of $900,000. dividends for one previous year are in arrears. how much cash will be paid to the preferred stockholders and the common stockholders, respectively, if cash dividends of $222,000 are distributed at the end of the current year?

Answers: 1

Another question on Business

Business, 21.06.2019 13:40

Aztic inc., a manufacturer of sports goods, plans to expand its operations to various other countries. during market research, it avoids countries where the dominant population is mostly rural. in this case, aztic inc. is assessing the of the countries

Answers: 1

Business, 22.06.2019 00:00

Choose the list of the best uses for word processing software. lists, resumes, writing a book, and payroll data letters to your friends, resumes, spreadsheets, and school papers resumes, cover letters, databases, and crossword puzzles book reports, letters to your friends, resumes, and contracts

Answers: 2

Business, 22.06.2019 08:00

Suppose that xtel currently is selling at $40 per share. you buy 500 shares using $15,000 of your own money, borrowing the remainder of the purchase price from your broker. the rate on the margin loan is 8%. a. what is the percentage increase in the net worth of your brokerage account if the price of xtel immediately changes to (a) $44; (b) $40; (c) $36? (leave no cells blank - be certain to enter "0" wherever required. negative values should be indicated by a minus sign. round your answers to 2 decimal places.) b. if the maintenance margin is 25%, how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.) c. how would your answer to requirement 2 would change if you had financed the initial purchase with only $10,000 of your own money? (round your answer to 2 decimal places.) d. what is the rate of return on your margined position (assuming again that you invest $15,000 of your own money) if xtel is selling after one year at (a) $44; (b) $40; (c) $36? (negative values should be indicated by a minus sign. round your answers to 2 decimal places.) e. continue to assume that a year has passed. how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.)

Answers: 1

Business, 22.06.2019 17:30

What is the sequence of events that could lead to trade surplus

Answers: 3

You know the right answer?

The frank company has issued 10%, fully participating, cumulative preferred stock with a total par v...

Questions

History, 13.01.2021 16:20

English, 13.01.2021 16:20

Mathematics, 13.01.2021 16:20

History, 13.01.2021 16:20

History, 13.01.2021 16:20

Mathematics, 13.01.2021 16:20

Chemistry, 13.01.2021 16:20

English, 13.01.2021 16:20

Mathematics, 13.01.2021 16:20

Mathematics, 13.01.2021 16:20

Mathematics, 13.01.2021 16:20