Business, 20.12.2019 21:31 khikhi1705

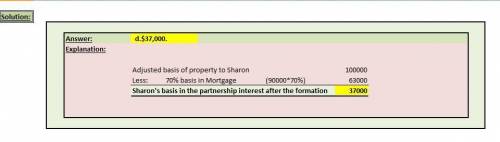

Sharon contributed property to the newly formed qrst partnership. the property had a $100,000 adjusted basis to sharon and a $160,000 fair market value on the contribution date. the property was also encumbered by a $90,000 nonrecourse debt, which was transferred to the partnership on that date. sharon is treated as a general partner. she is allocated 30% of qrst's profits, and 20% of qrst's losses. sharon's basis in the partnership interest after the formation transaction is:

a.$127,000.

b.$28,000.

c.$118,000.

d.$37,000.

e.$88,000.

Answers: 3

Another question on Business

Business, 22.06.2019 11:00

Why does an organization prepare a balance sheet? a. to reveal what the organization owns and owes at a point in time b. to reveal how well the company utilizes its cash c. to calculate retained earnings for a given accounting period d. to calculate gross profit for a given accounting period

Answers: 1

Business, 22.06.2019 11:40

Select the correct answer. which is a benefit of planning for your future career? a.being less prepared after high school. b.having higher tuition in college. c.earning college credits in high school. d.ruining your chances of having a successful career.

Answers: 2

Business, 22.06.2019 17:00

Serious question, which is preferred in a business? pp or poopoo?

Answers: 1

Business, 22.06.2019 21:20

What business practice contributed most to andrew carnegie’s ability to form a monopoly?

Answers: 1

You know the right answer?

Sharon contributed property to the newly formed qrst partnership. the property had a $100,000 adjust...

Questions

Business, 21.04.2021 09:50

Mathematics, 21.04.2021 09:50

Mathematics, 21.04.2021 09:50

Social Studies, 21.04.2021 09:50

Chemistry, 21.04.2021 09:50

English, 21.04.2021 09:50

English, 21.04.2021 09:50

English, 21.04.2021 09:50

English, 21.04.2021 09:50

Chemistry, 21.04.2021 09:50

History, 21.04.2021 09:50

English, 21.04.2021 09:50