Business, 20.12.2019 23:31 balwinderdev

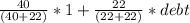

Hazel morrison, a mutual fund manager, has a $40 million portfolio with a beta of 1.00. the risk-free rate is 4.25%, and the market risk premium is 6.00%. hazel expects to receive an additional $60 million, which she plans to invest in additional stocks. after investing the additional funds, she wants the fund's required and expected return to be 13.00%. what must the average beta of the new stocks be to achieve the target required rate of return?

Answers: 3

Another question on Business

Business, 21.06.2019 23:50

Juan has a retail business selling skateboard supplies he maintains large stockpiles of every item he sells in a warehouse on the outskirts of town he keeps finding that he has to reorder certain supplies all the time but others only once a year how can he solve this problem?

Answers: 1

Business, 22.06.2019 20:00

Which motion below could be made so that the chair would be called on to enforce a violated rule?

Answers: 2

Business, 22.06.2019 20:00

If an investment has 35 percent more nondiversifiable risk than the market portfolio, its beta will be:

Answers: 1

Business, 23.06.2019 00:30

Kim davis is in the 40 percent personal tax bracket. she is considering investing in hca(taxable) bonds that carry a 12 percent interest rate. what is her after- tax yield(interest rate) on the bonds?

Answers: 1

You know the right answer?

Hazel morrison, a mutual fund manager, has a $40 million portfolio with a beta of 1.00. the risk-fre...

Questions

English, 07.12.2020 05:20

English, 07.12.2020 05:20

Mathematics, 07.12.2020 05:20

Mathematics, 07.12.2020 05:20

Social Studies, 07.12.2020 05:20

History, 07.12.2020 05:20

Mathematics, 07.12.2020 05:20

Mathematics, 07.12.2020 05:20

Biology, 07.12.2020 05:20

Mathematics, 07.12.2020 05:20