Business, 21.12.2019 02:31 4300224102

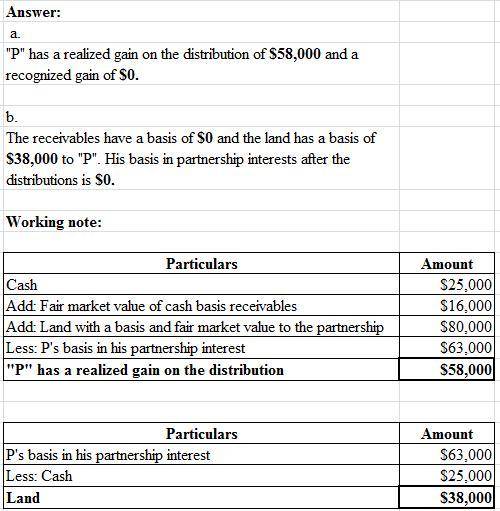

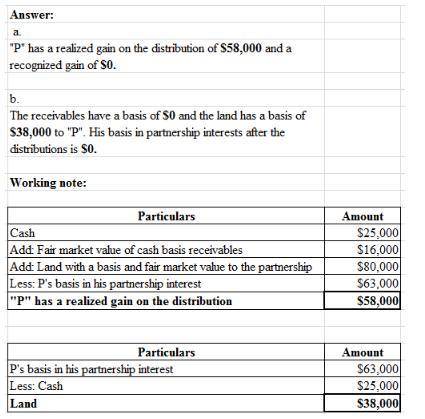

Pablo has a $63,000 basis in his partnership interest. on may 9 of the current tax year, the partnership distributes to him, in a proportionate nonliquidating distribution, cash of $25,000, cash basis receivables with an inside basis of $0 and a fair market value of $16,000, and land with a basis and fair market value to the partnership of $80,000.

if an amount is zero, enter "0".

a. how much is pablo’s realized and recognized gain on the distribution?

pablo has a realized gain on the distribution of $ and a recognized gain of $

b. what is pablo’s basis in the receivables, land, and partnership interest following the distribution?

the receivables have a basis of $ and the land has a basis of $ to pablo. his basis in partnership interests after the distributions is $

Answers: 3

Another question on Business

Business, 22.06.2019 01:30

Elliott company produces large quantities of a standardized product. the following information is available for its production activities for march. units costs beginning work in process inventory 2,500 beginning work in process inventory started 25,000 direct materials $ 3,725 ending work in process inventory 5,000 conversion 11,580 $ 15,305 status of ending work in process inventory direct materials added 185,750 materials—percent complete 100 % direct labor added 182,375 conversion—percent complete 30 % overhead applied (140% of direct labor) 255,325 total costs to account for $ 638,755 ending work in process inventory $ 62,530 prepare a process cost summary report for this company, showing costs charged to production, unit cost information, equivalent units of production, cost per eup, and its cost assignment and reconciliation. use the weighted-average method. (round "cost per eup" to 2 decimal places.)

Answers: 1

Business, 22.06.2019 12:50

Suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the foreseeable future. consider all factors that affect the yield curve. then identify which of the following shapes that the u.s. treasury yield curve can take. check all that apply.

Answers: 2

Business, 22.06.2019 13:40

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

Business, 22.06.2019 19:30

Consider the following two projects. both have costs of $5,000 in year 1. project 1 provides benefits of $2,000 in each of the first four years only. the second provides benefits of $2,000 for each of years 6 to 10 only. compute the net benefits using a discount rate of 6 percent. repeat using a discount rate of 12 percent. what can you conclude from this exercise?

Answers: 3

You know the right answer?

Pablo has a $63,000 basis in his partnership interest. on may 9 of the current tax year, the partner...

Questions

Health, 24.01.2021 07:10

Mathematics, 24.01.2021 07:10

Mathematics, 24.01.2021 07:10

Biology, 24.01.2021 07:10

Mathematics, 24.01.2021 07:20

Chemistry, 24.01.2021 07:20

Biology, 24.01.2021 07:20

Biology, 24.01.2021 07:20

English, 24.01.2021 07:20

Business, 24.01.2021 07:20

Biology, 24.01.2021 07:20

World Languages, 24.01.2021 07:20