Business, 21.12.2019 03:31 DaiDai8328

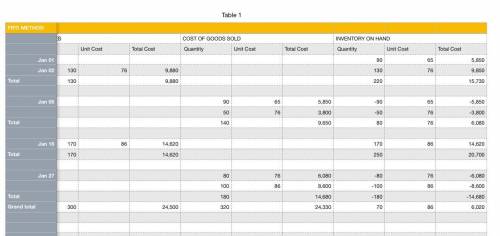

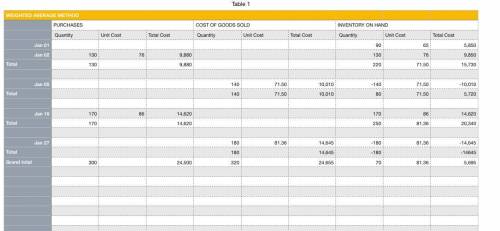

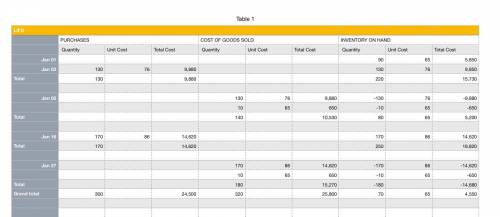

Fit world began january with merchandise inventory of 90 crates of vitamins that cost a total of $ 5,850. during the month, fit world purchased and sold merchandise on account as follows: jan 2 purchases 130 crates @ 76 eachjan 5 sale 140 crates @ 100 eachjan 16 purchases 170 crates @ 86 eachjan 27 sale 180 crates @ 104eachrequirement 1. prepare a perpetual inventory record, using the fifo inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. begin by computing the cost of goods sold and cost of ending merchandise inventory using the fifo inventory costing method. enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventorypurchased, sold, and on hand at the end of the period. (enter the oldest inventory layers first.)purchasescost of goods soldinventory on . 1251627totalsgross profit is $ using the fifo inventory costing method. requirement 2. prepare a perpetual inventory record, using the lifo inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. begin by computing the cost of goods sold and cost of ending merchandise inventory using the lifo inventory costing method. enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventorypurchased, sold, and on hand at the end of the period. (enter the oldest inventory layers first.)purchasescost of goods soldinventory on . 1251627totalsgross profit is $ the lifo inventory costing method. requirement 3. prepare a perpetual inventory record, using theweighted-average inventory costing method, and determine thecompany's cost of goods sold, ending merchandise inventory, and gross profit. begin by computing the cost of goods sold and cost of ending merchandise inventory using the weighted-average inventory costing method. enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventorypurchased, sold, and on hand at the end of the period. (round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar.)purchasescost of goods soldinventory on . 1251627totalsgross profit is $ the weighted-average inventory costing method. requirement 4. if the business wanted to pay the least amount of income taxes possible, which method would it choose? if the business wanted to pay the least amount of income taxespossible, they would choose (select correct answer; fifo, lifo or weighted-average).

Answers: 1

Another question on Business

Business, 21.06.2019 18:20

Which of the following housing decisions provides a person with both housing and an investment? a. selling a share in a cooperative. b. buying a single-family home. c. renting an apartment. d. subletting a condominium. 2b2t

Answers: 2

Business, 21.06.2019 21:30

The following account balances at the beginning of january were selected from the general ledger of fresh bagel manufacturing company: work in process inventory $0 raw materials inventory $ 28 comma 100 finished goods inventory $ 40 comma 600 additional data: 1. actual manufacturing overhead for january amounted to $ 65 comma 000. 2. total direct labor cost for january was $ 63 comma 400. 3. the predetermined manufacturing overhead rate is based on direct labor cost. the budget for the year called for $ 255 comma 000 of direct labor cost and $ 382 comma 500 of manufacturing overhead costs. 4. the only job unfinished on january 31 was job no. 151, for which total direct labor charges were $ 5 comma 200 (1 comma 300 direct labor hours) and total direct material charges were $ 14 comma 400. 5. cost of direct materials placed in production during january totaled $ 123 comma 700. there were no indirect material requisitions during january. 6. january 31 balance in raw materials inventory was $ 35 comma 300. 7. finished goods inventory balance on january 31 was $ 35 comma 400. what is the cost of goods manufactured for january?

Answers: 3

Business, 22.06.2019 03:00

5. profit maximization and shutting down in the short run suppose that the market for polos is a competitive market. the following graph shows the daily cost curves of a firm operating in this market. 0 2 4 6 8 10 12 14 16 18 20 50 45 40 35 30 25 20 15 10 5 0 price (dollars per polo) quantity (thousands of polos) mc atc avc for each price in the following table, calculate the firm's optimal quantity of units to produce, and determine the profit or loss if it produces at that quantity, using the data from the previous graph to identify its total variable cost. assume that if the firm is indifferent between producing and shutting down, it will produce. (hint: you can select the purple points [diamond symbols] on the previous graph to see precise information on average variable cost.) price quantity total revenue fixed cost variable cost profit (dollars per polo) (polos) (dollars) (dollars) (dollars) (dollars) 12.50 135,000 27.50 135,000 45.00 135,000 if the firm shuts down, it must incur its fixed costs (fc) in the short run. in this case, the firm's fixed cost is $135,000 per day. in other words, if it shuts down, the firm would suffer losses of $135,000 per day until its fixed costs end (such as the expiration of a building lease). this firm's shutdown price—that is, the price below which it is optimal for the firm to shut down—is per polo.

Answers: 3

Business, 22.06.2019 04:00

The simple interest in a loan of $200 at 10 percent interest per year is

Answers: 2

You know the right answer?

Fit world began january with merchandise inventory of 90 crates of vitamins that cost a total of $ 5...

Questions

History, 26.08.2019 01:30

Mathematics, 26.08.2019 01:30

History, 26.08.2019 01:30

Mathematics, 26.08.2019 01:30

History, 26.08.2019 01:30

English, 26.08.2019 01:30

Chemistry, 26.08.2019 01:30

Physics, 26.08.2019 01:30

History, 26.08.2019 01:30

Mathematics, 26.08.2019 01:30

Spanish, 26.08.2019 01:30

History, 26.08.2019 01:30

Mathematics, 26.08.2019 01:30