Business, 21.12.2019 06:31 cdjeter12oxoait

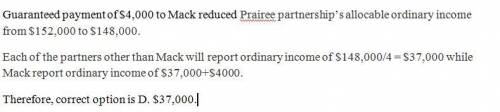

Prairie partnership has four equal partners, dodd, crank, pick, and mack. each of the partners had a tax basis of $320,000 as of january 1, 20x5. prairie’s 20x5 ordinary business income was $152,000 before deducting any guaranteed payments to the partners. during 20x5, prairie paid mack guaranteed payments of $4,000 for deductible services rendered. during 20x5, each of the four partners took a distribution of $50,000. what is mack’s tax basis in prairie on december 31, 20x5?

Answers: 2

Another question on Business

Business, 22.06.2019 07:50

The questions of economics address which of the following ? check all that apply

Answers: 3

Business, 22.06.2019 12:00

In the united states, one worker can produce 10 tons of steel per day or 20 tons of chemicals per day. in the united kingdom, one worker can produce 5 tons of steel per day or 15 tons of chemicals per day. the united kingdom has a comparative advantage in the production of:

Answers: 2

Business, 22.06.2019 16:10

Answer the following questions using the banker’s algorithm: a. illustrate that the system is in a safe state by demonstrating an order in which the processes may complete. b. if a request from process p1 arrives for (1, 1, 0, 0), can the request be granted immediately? c. if a request from process p

Answers: 1

Business, 23.06.2019 06:10

Which of the following functions finds the highest value of selected inputs? a. high b. hvalue c. max

Answers: 3

You know the right answer?

Prairie partnership has four equal partners, dodd, crank, pick, and mack. each of the partners had a...

Questions

Mathematics, 20.04.2021 23:20

Mathematics, 20.04.2021 23:20

Mathematics, 20.04.2021 23:20

Mathematics, 20.04.2021 23:20

English, 20.04.2021 23:20

Mathematics, 20.04.2021 23:20

English, 20.04.2021 23:20

Mathematics, 20.04.2021 23:20

Mathematics, 20.04.2021 23:30

Mathematics, 20.04.2021 23:30

Chemistry, 20.04.2021 23:30