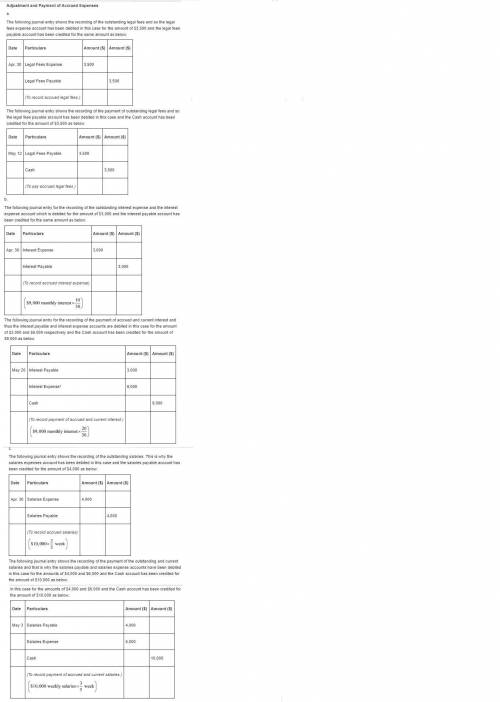

A. on april 1, the company retained an attorney for a flat monthly fee of $3,500. payment for april legal services was made by the company on may 12.b. a $900,000 note payable requires 12% annual interest, or $9,000, to be paid at the 20th day of each month. the interest was last paid on april 20, and the next payment is due on may 20. as of april 30, $3,000 of interest expense has accrued. c. total weekly salaries expense for all employees is $10,000. this amount is paid at the end of the day on friday of each five-day workweek. april 30 falls on a tuesday, which means that the employees had worked two days since the last payday. the next payday is may 3. required: 1. the above three separate situations require adjusting journal entries to prepare financial statements as of april 30. 2. for each situation, present both: i. the april 30 adjusting entry. ii. the subsequent entry during may to record payment of the accrued expenses.

Answers: 1

Another question on Business

Business, 22.06.2019 11:40

If kroger had whole foods’ number of days’ sales in inventory, how much additional cash flow would have been generated from the smaller inventory relative to its actual average inventory position? round interim calculations to one decimal place and your final answer to the nearest million.

Answers: 2

Business, 22.06.2019 20:20

Which of the following entries would be made to record the requisition of $12,000 of direct materials and $6,900 of indirect materials? (assume that indirect materials are included in raw materials inventory.) a. manufacturing overhead 18,900 raw materials inventory 18,900 b. wip inventory 12,000 manufacturing overhead 6,900 raw materials inventory 18,900 c. raw materials inventory 18,900 wip inventory 18,900 d. wip inventory 18,900 raw materials inventory 18,900

Answers: 1

Business, 23.06.2019 00:50

Exercise 12-7 shown below are comparative balance sheets for flint corporation. flint corporation comparative balance sheets december 31 assets 2017 2016 cash $ 201,348 $ 65,142 accounts receivable 260,568 225,036 inventory 494,487 559,629 land 236,880 296,100 equipment 769,860 592,200 accumulated depreciation—equipment (195,426 ) (94,752 ) total $1,767,717 $1,643,355 liabilities and stockholders’ equity accounts payable $ 115,479 $ 127,323 bonds payable 444,150 592,200 common stock ($1 par) 639,576 515,214 retained earnings 568,512 408,618 total $1,767,717 $1,643,355 additional information: 1. net income for 2017 was $275,373. 2. depreciation expense was $100,674. 3. cash dividends of $115,479 were declared and paid. 4. bonds payable amounting to $148,050 were redeemed for cash $148,050. 5. common stock was issued for $124,362 cash. 6. no equipment was sold during 2017. 7. land was sold for its book value. prepare a statement of cash flows for 2017 using the indirect method.

Answers: 1

Business, 23.06.2019 01:10

Atariff on avocadoes the price of avocadoes, consumers' surplus for avocado buyers, producers' surplus of avocado growers and tariff revenue. because the loss to is more than the gain to there is a net loss to society.raises; decreases; increases; generates; consumers; producers and government raises; increases; decreases; does not generate; producers and government; consumers lowers; increases; decreases; does not generate; producers and government; consumers raises; increases; decreases; generates; producers; consumers and government

Answers: 2

You know the right answer?

A. on april 1, the company retained an attorney for a flat monthly fee of $3,500. payment for april...

Questions

Mathematics, 21.07.2019 13:00

History, 21.07.2019 13:00

Health, 21.07.2019 13:00

Mathematics, 21.07.2019 13:00

World Languages, 21.07.2019 13:00

Mathematics, 21.07.2019 13:00

Social Studies, 21.07.2019 13:00