Business, 24.12.2019 19:31 alyssamiller401

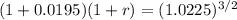

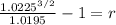

You observe the 12-month and 18-month zero coupon rates for u. s. treasury securities are 1.95% and 2.25%, respectively. assuming arbitrage free markets and no friction costs, the implied 6-month rate in 12 months’ time should be closest to:

Answers: 1

Another question on Business

Business, 22.06.2019 13:30

Hundreds of a bank's customers have called the customer service call center to complain that they are receiving text messages on their phone telling them to access a website and enter personal information to resolve an issue with their account. what action should the bank take?

Answers: 2

Business, 22.06.2019 19:50

At the beginning of 2014, winston corporation issued 10% bonds with a face value of $2,000,000. these bonds mature in five years, and interest is paid semiannually on june 30 and december 31. the bonds were sold for $1,852,800 to yield 12%. winston uses a calendar-year reporting period. using the effective-interest method of amortization, what amount of interest expense should be reported for 2014? (round your answer to the nearest dollar.)

Answers: 2

Business, 22.06.2019 20:30

What could cause a production possibilities curve to move down and to the left? a.) a nation loses land after being defeated in a war. b.) an increase in the use of computer technology speeds up production c.) a baby boom 20 years ago results in a large number of young adults in the population today. d.) thousands of investors from overseas invest money in a nations economy.

Answers: 1

Business, 23.06.2019 00:50

Aproduction department's output for the most recent month consisted of 8,000 units completed and transferred to the next stage of production and 5,000 units in ending work in process inventory. the units in ending work in process inventory were 50% complete with respect to both direct materials and conversion costs. calculate the equivalent units of production for the month, assuming the company uses the weighted average method.

Answers: 3

You know the right answer?

You observe the 12-month and 18-month zero coupon rates for u. s. treasury securities are 1.95% and...

Questions

Chemistry, 10.11.2020 21:40

Mathematics, 10.11.2020 21:40

Advanced Placement (AP), 10.11.2020 21:40

History, 10.11.2020 21:40

Mathematics, 10.11.2020 21:40

Mathematics, 10.11.2020 21:40

Mathematics, 10.11.2020 21:40

Mathematics, 10.11.2020 21:40

Chemistry, 10.11.2020 21:40

Social Studies, 10.11.2020 21:40

English, 10.11.2020 21:40

World Languages, 10.11.2020 21:40