Business, 24.12.2019 21:31 gymnastcaitlyn1

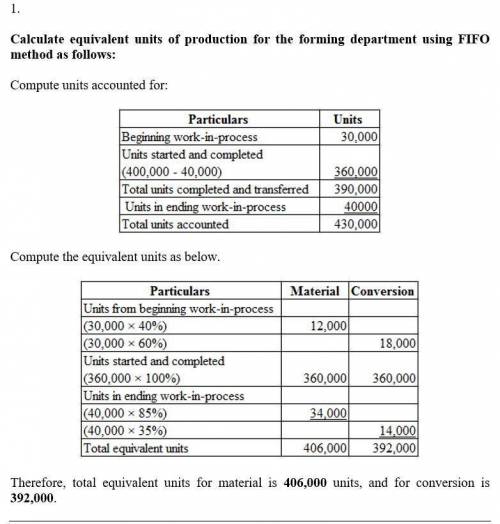

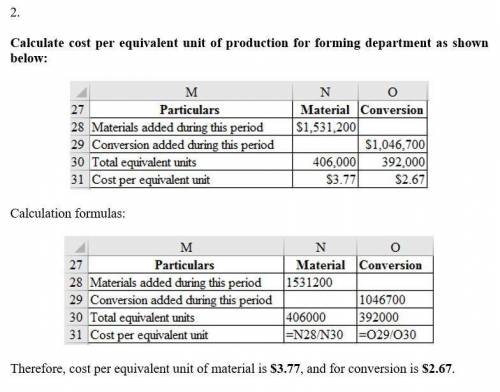

The fields company has two manufacturing departments, forming and painting. the company uses the weighted-average method of process costing. at the beginning of the month, the forming department has 30,000 units in inventory, 60% complete as to materials and 40% complete as to conversion costs. the beginning inventory cost of $70,100 consisted of $50,800 of direct material costs and $19,300 of conversion cost. during the month, the forming department started 400,000 units. at the end of the month, the forming department had 40,000 units in ending inventory, 85% complete as to materials and 35% complete as to conversion. units completed in the forming department are transferred to the painting department. cost information for the forming department is as follows: beginning work in process inventory $ 70,100 direct materials added during the month 1,531,200 conversion added during the month 1,046,700assume that fields uses the fifo method of process costing.1. calculate the equivalent units of production for the forming departmentdirect materials conversion. 2. calculate the costs per equivalent unit of production for the forming department. (round your answer to 2 decimal places.)direct materials eupconversion eup

Answers: 2

Another question on Business

Business, 21.06.2019 21:30

The following balance sheet for the los gatos corporation was prepared by a recently hired accountant. in reviewing the statement you notice several errors. los gatos corporation balance sheet at december 31, 2018 assets cash $ 44,000 accounts receivable 86,000 inventories 57,000 machinery (net) 122,000 franchise (net) 32,000 total assets $ 341,000 liabilities and shareholders' equity accounts payable $ 54,000 allowance for uncollectible accounts 7,000 note payable 59,000 bonds payable 112,000 shareholders' equity 109,000 total liabilities and shareholders' equity $ 341,000 additional information: cash includes a $22,000 restricted amount to be used for repayment of the bonds payable in 2022. the cost of the machinery is $194,000. accounts receivable includes a $22,000 note receivable from a customer due in 2021. the note payable includes accrued interest of $7,000. principal and interest are both due on february 1, 2019. the company began operations in 2013. income less dividends since inception of the company totals $37,000. 52,000 shares of no par common stock were issued in 2013. 200,000 shares are authorized. required: prepare a corrected, classified balance sheet. (amounts to be deducted should be indicated by a minus sign.)

Answers: 2

Business, 22.06.2019 02:00

Southeastern bell stocks a certain switch connector at its central warehouse for supplying field service offices. the yearly demand for these connectors is 15,000 units. southeastern estimates its annual holding cost for this item to be $25 per unit. the cost to place and process an order from the supplier is $75. the company operates 300 days per year, and the lead time to receive an order from the supplier is 2 working days.a) find the economic order quantity.b) find the annual holding costs.c) find the annual ordering costs.d) what is the reorder point?

Answers: 2

Business, 22.06.2019 06:30

If a team of three workers, each making the u.s. federal minimum wage, produced these 12 rugs, what would the total labor cost be? don't forget that these workers would be working overtime.

Answers: 3

Business, 22.06.2019 10:50

Melissa is a very generous single woman. before this year, she had given over $11,400,000 in taxable gifts over the years and has completely exhausted her applicable credit amount. in the current year, melissa gave her daughter riley $100,000 and promptly filed her gift tax return. melissa did not make any other gifts this year. how much gift tax must riley pay the irs because of this transaction?

Answers: 2

You know the right answer?

The fields company has two manufacturing departments, forming and painting. the company uses the wei...

Questions

Business, 02.02.2022 08:40

Geography, 02.02.2022 08:40

Biology, 02.02.2022 08:40

Mathematics, 02.02.2022 08:50

Biology, 02.02.2022 08:50

Spanish, 02.02.2022 08:50

SAT, 02.02.2022 08:50