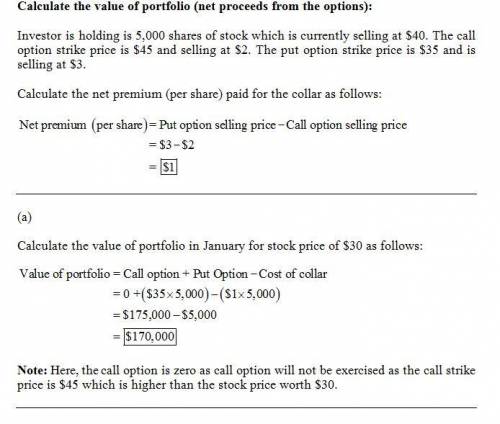

Imagine that you are holding 5,000 shares of stock, currently selling at $40 per share. you are ready to sell the shares but would prefer to put off the sale until next year for tax reasons. if you continue to hold the shares until january, however, you face the risk that the stock will drop in value before year end. you decide to use a collar to limit downside risk without laying out a good deal of additional funds. january call options with a strike of $45 are selling at $2, and january puts with a strike price of $35 are selling at $3. assume that you hedge the entire 5,000 shares of stock.

(a)

what will be the value of your portfolio in january (net of the proceeds from the options) if the stock price ends up at $30. (omit the "$" sign in your response.)

stock price $

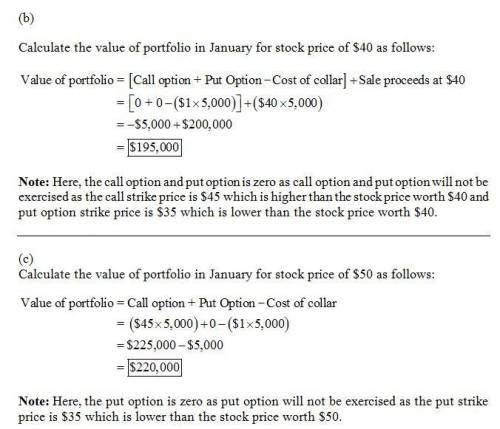

(b)

what will be the value of your portfolio in january (net of the proceeds from the options) if the stock price ends up at $40? (omit the "$" sign in your response.)

stock price $

(c)

what will be the value of your portfolio in january (net of the proceeds from the options) if the stock price ends up at $50? (omit the "$" sign in your response.)

stock price $

Answers: 3

Another question on Business

Business, 22.06.2019 05:00

You are chairman of the board of a successful technology firm. there is a nominal federal corporate tax rate of 35 percent, yet the effective tax rate of the typical corporation is about 12.6%. your firm has been clever with use of transfer pricing and keeping money abroad and has barely paid any taxes over the last 5 years; during this same time period, profits were $28 billion. one member of the board feels that it is un-american to use various accounting strategies in order to avoid paying taxes. others feel that these are legal loopholes and corporations have a fiduciary responsibility to minimize taxes. one board member quoted what the ceo of exxon once said: “i’m not a u.s. company and i don’t make decisions based on what’s good for the u.s.” what are the alternatives? what are your recommendations? why do you recommend this course of action?

Answers: 2

Business, 22.06.2019 11:40

On january 1, 2017, sophie's sunlounge owned 4 tanning beds valued at $20,000. during 2017, sophie's bought 3 new beds at a total cost of $14 comma 000, and at the end of the year the market value of all of sophie's beds was $24 comma 000. what was sophie's net investment

Answers: 3

Business, 22.06.2019 13:30

Tom has brought $150,000 from his pension to a new job where his employer will match 401(k) contributions dollar for dollar. each year he contributes $3,000. after seven years, how much money would tom have in his 401(k)?

Answers: 3

You know the right answer?

Imagine that you are holding 5,000 shares of stock, currently selling at $40 per share. you are read...

Questions

Social Studies, 22.01.2020 21:31

Mathematics, 22.01.2020 21:31

History, 22.01.2020 21:31

Mathematics, 22.01.2020 21:31

English, 22.01.2020 21:31

English, 22.01.2020 21:31

Mathematics, 22.01.2020 21:31

Mathematics, 22.01.2020 21:31

History, 22.01.2020 21:31