Business, 25.12.2019 19:31 camperjamari12

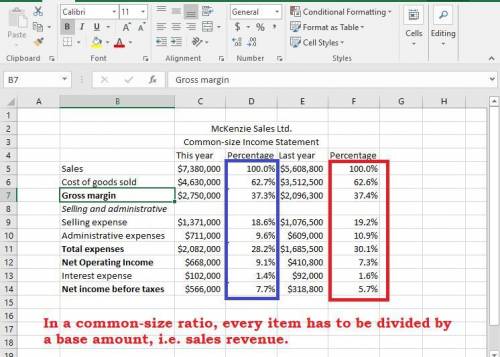

Acomparative income statement is given below for mckenzie sales, ltd., of toronto: mckenzie sales, ltd. comparative income statement this year last year sales $ 7,380,000 $ 5,608,800 cost of goods sold 4,630,000 3,512,500 gross margin 2,750,000 2,096,300 selling and administrative expenses: selling expenses 1,371,000 1,076,500 administrative expenses 711,000 609,000 total expenses 2,082,000 1,685,500 net operating income 668,000 410,800 interest expense 102,000 92,000 net income before taxes $ 566,000 $ 318,800 members of the company’s board of directors are surprised to see that net income increased by only $247,200 when sales increased by $1,771,200.

required:

1. express each year's income statement in common-size percentages. (round your percentage answers to 1 decimal place (i. e., 0.1234 should be entered as 12.

Answers: 3

Another question on Business

Business, 22.06.2019 04:10

An outside manufacturer has offered to produce 60,000 daks and ship them directly to andretti's customers. if andretti company accepts this offer, the facilities that it uses to produce daks would be idle; however, fixed manufacturing overhead costs would be reduced by 75%. because the outside manufacturer would pay for all shipping costs, the variable selling expenses would be only two-thirds of their present amount. what is andretti's avoidable cost per unit that it should compare to the price quoted by the outside manufacturer?

Answers: 3

Business, 22.06.2019 12:50

Salaries are $4,500 per week for five working days and are paid weekly at the end of the day fridays. the end of the month falls on a thursday. the accountant for dayton company made the appropriate accrual adjustment and posted it to the ledger. the balance of salaries payable, as shown on the adjusted trial balance, will be a (assume that there was no beginning balance in the salaries payable account.)

Answers: 1

Business, 22.06.2019 14:40

You are purchasing a bond that currently sold for $985.63. it has the time-to-maturity of 10 years and a coupon rate of 6%, paid semi-annually. the bond can be called for $1,020 in 3 years. what is the yield to maturity of this bond?

Answers: 2

Business, 22.06.2019 18:00

Abbington company has a manufacturing facility in brooklyn that manufactures robotic equipment for the auto industry. for year 1, abbingtonabbington collected the following information from its main production line: actual quantity purchased-200 units, actual quantity used-110 units, units standard quantity-100 units, actual price paid-$8 per unit, standard price-$10 per unit. atlantic isolates price variances at the time of purchase. what is the materials price variance for year 1? 1. $400 favorable. 2. $400 unfavorable. 3. $220 favorable. 4. $220 unfavorable.

Answers: 2

You know the right answer?

Acomparative income statement is given below for mckenzie sales, ltd., of toronto: mckenzie sales,...

Questions

Physics, 26.11.2019 10:31

Mathematics, 26.11.2019 10:31

Mathematics, 26.11.2019 10:31

Biology, 26.11.2019 10:31

Social Studies, 26.11.2019 10:31

Chemistry, 26.11.2019 10:31

Social Studies, 26.11.2019 10:31

History, 26.11.2019 10:31

Arts, 26.11.2019 10:31