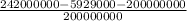

Consider a hedge fund with $200 million at the start of the year. the benchmark s& p 500 index was up 16.5% during the same period. the gross return on assets is 21%, and the expense ratio is 2%. for each 1% above the benchmark return, the fund managers receive a .1% incentive bonus. what was the annual return on this fund?

Answers: 1

Another question on Business

Business, 21.06.2019 17:30

If you want to compare two different investments, what should you calculate

Answers: 2

Business, 22.06.2019 01:00

Azster inc. recorded sales revenue for the year that ended december 31, 2014 as $67,000. interest revenue of $5,300 and expenses of $14,000 were also recorded for the same period. what is aster’s net profit or loss?

Answers: 3

Business, 22.06.2019 19:30

Kirnon clinic uses client-visits as its measure of activity. during july, the clinic budgeted for 3,250 client-visits, but its actual level of activity was 3,160 client-visits. the clinic has provided the following data concerning the formulas to be used in its budgeting: fixed element per month variable element per client-visitrevenue - $ 39.10personnel expenses $ 35,100 $ 10.30medical supplies 1,100 7.10occupancy expenses 8,100 1.10administrative expenses 5,100 0.20total expenses $ 49,400 $ 18.70the activity variance for net operating income in july would be closest to:

Answers: 1

Business, 22.06.2019 20:00

River corp's total assets at the end of last year were $415,000 and its net income was $32,750. what was its return on total assets? a. 7.89%b. 8.29%c. 8.70%d. 9.14%e. 9.59%

Answers: 3

You know the right answer?

Consider a hedge fund with $200 million at the start of the year. the benchmark s& p 500 index w...

Questions

Mathematics, 19.02.2021 22:50

Mathematics, 19.02.2021 22:50

Mathematics, 19.02.2021 22:50

Chemistry, 19.02.2021 22:50

Chemistry, 19.02.2021 22:50

Chemistry, 19.02.2021 22:50

Spanish, 19.02.2021 22:50

Mathematics, 19.02.2021 22:50

Biology, 19.02.2021 22:50

Geography, 19.02.2021 22:50

Mathematics, 19.02.2021 22:50

English, 19.02.2021 22:50