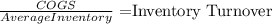

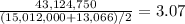

Pascarella inc. is revising its payables policy. it has annual sales of $50,735,000, an average inventory level of $15,012,000, and average accounts receivable of $10,008,000. the firm's cost of goods sold is 85% of sales. the company makes all purchases on credit and has always paid on the 30th day. however, it now plans to take full advantage of trade credit and to pay its suppliers on the 40th day. the cfo also believes that sales can be maintained at the existing level but inventory can be lowered by $1,946,000 and accounts receivable by $1,946,000. what will be the net change in the cash conversion cycle, assuming a 365-day year

Answers: 1

Another question on Business

Business, 22.06.2019 05:30

Identify the three components of a family's culture and provide one example from your own experience

Answers: 2

Business, 22.06.2019 06:10

P11.2a (lo 2, 4) fechter corporation had the following stockholders’ equity accounts on january 1, 2020: common stock ($5 par) $500,000, paid-in capital in excess of par—common stock $200,000, and retained earnings $100,000. in 2020, the company had the following treasury stock transactions. journalize and post treasury stock transactions, and prepare stockholders’ equity section. mar. 1 purchased 5,000 shares at $8 per share. june 1 sold 1,000 shares at $12 per share. sept. 1 sold 2,000 shares at $10 per share. dec. 1 sold 1,000 shares at $7 per share. fechter corporation uses the cost method of accounting for treasury stock. in 2020, the company reported net income of $30,000. instructions a. journalize the treasury stock transactions, and prepare the closing entry at december 31, 2020, for net income. b. open accounts for (1) paid-in capital from treasury stock, (2) treasury stock, and (3) retained earnings. (post to t-accounts.) c. prepare the stockholders’ equity section for fechter corporation at december 31, 2020.

Answers: 1

Business, 22.06.2019 16:10

The brs corporation makes collections on sales according to the following schedule: 30% in month of sale 66% in month following sale 4% in second month following sale the following sales have been budgeted: sales april $ 130,000 may $ 150,000 june $ 140,000 budgeted cash collections in june would be:

Answers: 1

You know the right answer?

Pascarella inc. is revising its payables policy. it has annual sales of $50,735,000, an average inve...

Questions

Mathematics, 17.07.2020 17:01

Geography, 17.07.2020 17:01

Social Studies, 17.07.2020 17:01

Mathematics, 17.07.2020 17:01

Mathematics, 17.07.2020 17:01

Mathematics, 17.07.2020 17:01