Business, 26.12.2019 22:31 sriggins1375

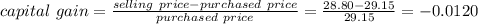

One year ago, you bought a stock for $29.15 a share. you received a dividend of $1.04 per share last month and sold the stock today for $28.80 a share. what is the capital gains yield on this investment

Answers: 1

Another question on Business

Business, 22.06.2019 03:00

1) u.s. real gdp is substantially higher today than it was 60 years ago. what does this tell us, and what does it not tell us, about the well-being of u.s. residents? what are the limitations of the gdp as a measure of economic well-being? given the limitations, why is gdp usually regarded as the best single measure of a society’s economic well-being? 2) what is an intermediate good? how does an intermediate good differ from a final good? explain why it is the case that the value of intermediate goods produced and sold during the year is not included directly as part of gdp, but the value of intermediate goods produced and not sold is included directly as part of gdp.

Answers: 2

Business, 22.06.2019 05:50

Cosmetic profits. sally is the executive vice president of big name cosmetics company. through important and material, nonpublic information, she learns that the company is soon going to purchase a smaller chain of stores. it is expected that stock in big name cosmetics will rise dramatically at that point. sally immediately buys a number of shares of her company's stock. she also tells her friend alice about the expected purchase of stores. alice wanted to purchase stock in the company but lacked the funds with which to do so. although she did not have the funds in bank a, alice decided to draw a check on bank a and deposit the check in bank b and then proceed to write a check on bank b to cover the purchase of the stock. she hoped that she would have sufficient funds to deposit before the check was presented for payment. of which of the following offenses, if any, is alice guilty of by buying stock?

Answers: 2

Business, 22.06.2019 13:40

Randall's, inc. has 20,000 shares of stock outstanding with a par value of $1.00 per share. the market value is $12 per share. the balance sheet shows $42,000 in the capital in excess of par account, $20,000 in the common stock account, and $50,500 in the retained earnings account. the firm just announced a 5 percent (small) stock dividend. what will the balance in the retained earnings account be after the dividend?

Answers: 1

Business, 22.06.2019 20:10

As the inventor of hypertension medication, onesure pharmaceuticals (osp) inc. was able to reap the benefits of economies of scale due to a large consumer demand for the drug. even when competitors later developed similar drugs after the expiry of osp's patents, regular users did not want to switch because they were concerned about possible side effects. which of the following benefits does this scenario best illustrate? a. first-mover advantages b. social benefits c. network externalities d. fringe benefits

Answers: 3

You know the right answer?

One year ago, you bought a stock for $29.15 a share. you received a dividend of $1.04 per share last...

Questions

Mathematics, 10.11.2020 04:50

History, 10.11.2020 04:50

Mathematics, 10.11.2020 04:50

Mathematics, 10.11.2020 04:50

Mathematics, 10.11.2020 04:50

Chemistry, 10.11.2020 04:50

Mathematics, 10.11.2020 04:50

Mathematics, 10.11.2020 04:50

Chemistry, 10.11.2020 04:50

Mathematics, 10.11.2020 04:50

= -1.20 %

= -1.20 %