Business, 15.01.2020 01:31 nakiyapulley7466

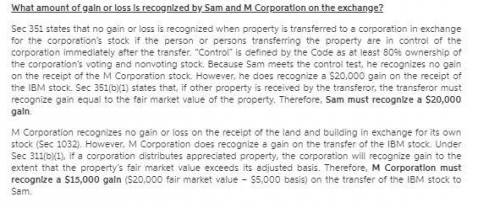

Sam owns 100% of m corporation’s single class of stock. sam transfers land and a building having a $30,000 and $100,000 adjusted basis, respectively, to m corporation in exchange for additional m corporation common stock worth $200,000 and ibm stock worth $20,000. the ibm stock had a $5,000 basis on m corporation’s books. peter transfers $50,000 in cash for 15% of the m corporation common stock. what amount of gain or loss is recognized by sam and m corporation on the exchange? sam has come to you for advice so provide him with professional memo on the isssue, based on the irc, treasury regulations, ruling and court cases if applicable. do not use irs publication or other unreliable sources. use proper tax language and irac form - issues,. rules, analysis conclusion..

Answers: 2

Another question on Business

Business, 21.06.2019 16:10

Braverman company has two manufacturing departments—finishing and fabrication. the predetermined overhead rates in finishing and fabrication are $18.00 per direct labor-hour and 110% of direct materials cost, respectively. the company’s direct labor wage rate is $16.00 per hour. the following information pertains to job 700: finishing fabrication direct materials $ 410 $ 60 direct labor $ 128 $ 48 required: 1. what is the total manufacturing cost assigned to job 700? 2. if job 700 consists of 15 units, what is the unit product cost for this job?

Answers: 1

Business, 21.06.2019 19:00

Ashare stock is a small piece of ownership in a company ture or false

Answers: 2

Business, 22.06.2019 12:30

On june 1, 2017, blossom company was started with an initial investment in the company of $22,360 cash. here are the assets, liabilities, and common stock of the company at june 30, 2017, and the revenues and expenses for the month of june, its first month of operations: cash $4,960 notes payable $12,720 accounts receivable 4,340 accounts payable 840 service revenue 7,860 supplies expense 1,100 supplies 2,300 maintenance and repairs expense 700 advertising expense 400 utilities expense 200 equipment 26,360 salaries and wages expense 1,760 common stock 22,360 in june, the company issued no additional stock but paid dividends of $1,660. prepare an income statement for the month of june.

Answers: 3

Business, 22.06.2019 14:30

The state in which the manufacturing company you work for is located regulates the presence of a particular substance in the environment to concentrations ≤ x. recently-released, reliable research endorsed by the responsible federal agency conclusively demonstrates that the substance poses no risks at concentrations up to 5x. your company has asked you to consider designing a new process with a waste discharge stream containing up to 2x of the substance. based on the stated conditions, describe this possible.

Answers: 2

You know the right answer?

Sam owns 100% of m corporation’s single class of stock. sam transfers land and a building having a $...

Questions

Mathematics, 19.04.2021 01:10

Mathematics, 19.04.2021 01:10

Mathematics, 19.04.2021 01:10

Chemistry, 19.04.2021 01:10

English, 19.04.2021 01:10

Mathematics, 19.04.2021 01:10

History, 19.04.2021 01:10

Mathematics, 19.04.2021 01:10

Mathematics, 19.04.2021 01:10

Mathematics, 19.04.2021 01:10