Business, 17.01.2020 19:31 jrsecession

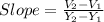

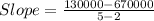

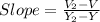

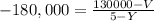

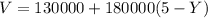

For tax and accounting purposes, corporations depreciate the value of equipment each year. one method used is called "linear depreciation," where the value decreases over time in a linear manner. suppose that two years after purchase, an industrial milling machine is worth $670,000, and five years after purchase, the machine is worth $130,000. find a formula for the machine value v (in thousands of dollars) at time t ≥ 0 after purchase.

Answers: 3

Another question on Business

Business, 21.06.2019 23:00

Assume today is december 31, 2013. barrington industries expects that its 2014 after-tax operating income [ebit(1 – t)] will be $400 million and its 2014 depreciation expense will be $70 million. barrington's 2014 gross capital expenditures are expected to be $120 million and the change in its net operating working capital for 2014 will be $25 million. the firm's free cash flow is expected to grow at a constant rate of 4.5% annually. assume that its free cash flow occurs at the end of each year. the firm's weighted average cost of capital is 8.6%; the market value of the company's debt is $2.15 billion; and the company has 180 million shares of common stock outstanding. the firm has no preferred stock on its balance sheet and has no plans to use it for future capital budgeting projects. using the corporate valuation model, what should be the company's stock price today (december 31, 2013)? round your answer to the nearest cent. do not round intermediate calculations.

Answers: 1

Business, 22.06.2019 16:40

Job 456 was recently completed. the following data have been recorded on its job cost sheet: direct materials $ 2,418 direct labor-hours 74 labor-hours direct labor wage rate $ 13 per labor-hour machine-hours 137 machine-hours the corporation applies manufacturing overhead on the basis of machine-hours. the predetermined overhead rate is $14 per machine-hour. the total cost that would be recorded on the job cost sheet for job 456 would be: multiple choice $3,380 $5,298 $6,138 $2,622

Answers: 1

Business, 23.06.2019 12:00

Michael works in an it firm that is well known for making innovative products. michael is asked to develop a product that would serve an unmet need. though he has many ideas for it, none of them quite fits the bill. he finally decides to stand back from the problem for a period of time and ceases to consciously think about the yet-to-be-developed product. after a week, as he looks over his notes, he realizes the solution. the period of time in which michael did not consciously work on the problem is referred to as

Answers: 1

Business, 23.06.2019 21:30

"a critical element of this step in the ethical decision-making process will be the consideration of ways to mitigate, minimize, or compensate for any possible harmful consequences or to increase and promote beneficial consequences." which step is this?

Answers: 1

You know the right answer?

For tax and accounting purposes, corporations depreciate the value of equipment each year. one metho...

Questions

Geography, 01.02.2021 22:30

History, 01.02.2021 22:30

Mathematics, 01.02.2021 22:30

Biology, 01.02.2021 22:30

History, 01.02.2021 22:30

Health, 01.02.2021 22:30

Mathematics, 01.02.2021 22:30

History, 01.02.2021 22:30