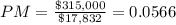

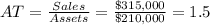

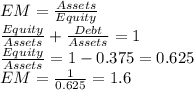

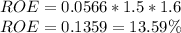

Last year vaughn corp. had sales of $315,000 and a net income of $17,832, and its year-end assets were $210,000. the firm's total-debt-to-total-assets ratio was 37.5%. based on the dupont equation, what was vaughn's roe? select the correct answer. a. 12.55% b. 13.07% c. 13.59% d. 12.03% e. 11.51%

Answers: 3

Another question on Business

Business, 22.06.2019 10:20

Asmartphone manufacturing company uses social media to achieve different business objectives. match each social media activity of the company to the objective it the company achieve.

Answers: 3

Business, 22.06.2019 21:50

Q3. loral corporation manufactures parts for an aircraft company. it uses a computerized numerical controlled (cnc) machining center to produce a specific part that has a design (nominal) target of 1.275 inches with tolerances of ± 0.020 inch. the cnc process that manufactures these parts has a mean of 1.285 inches and a standard deviation of 0.005 inch. compute the process capability ratio and process capability index, and comment on the overall capability of the process to meet the design specifications.

Answers: 1

Business, 23.06.2019 01:50

Consider a firm with a contract to sell an asset for $149,000 four years from now. the asset costs $85,000 to produce today. a. given a relevant discount rate of 14 percent per year, calculate the profit the firm will make on this asset. (a loss should be indicated by a minus sign. do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. at what rate does the firm just break even?

Answers: 3

You know the right answer?

Last year vaughn corp. had sales of $315,000 and a net income of $17,832, and its year-end assets we...

Questions

History, 01.10.2021 03:20

Social Studies, 01.10.2021 03:20

English, 01.10.2021 03:20

Mathematics, 01.10.2021 03:20

Social Studies, 01.10.2021 03:20

Chemistry, 01.10.2021 03:20

Biology, 01.10.2021 03:20

Mathematics, 01.10.2021 03:20

Mathematics, 01.10.2021 03:20