Business, 28.01.2020 22:41 coralstoner6793

Snapshot company, a commercial photography studio, has just completed its first full year of operations on december 31, 2015. general ledger account balances before year-end adjustments follow; no adjusting entries have been made to the accounts at any time during the year. assume that all balances are normal.

cash $2150

prepaid rent $1,910

supplies 3,800

unearned photography fees 26,00

common stock 24,000

wages expense 11,000

equipment 22,800

utilities expense 3,420

an analysis of the firm's records discloses the following.

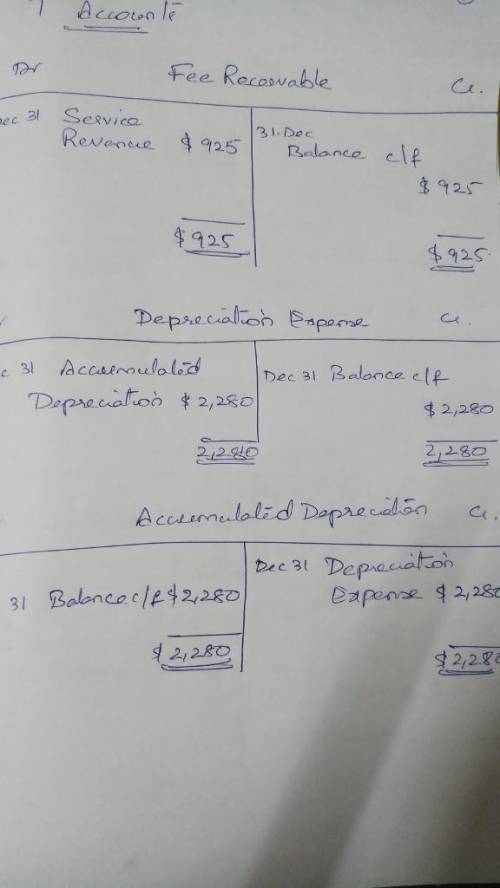

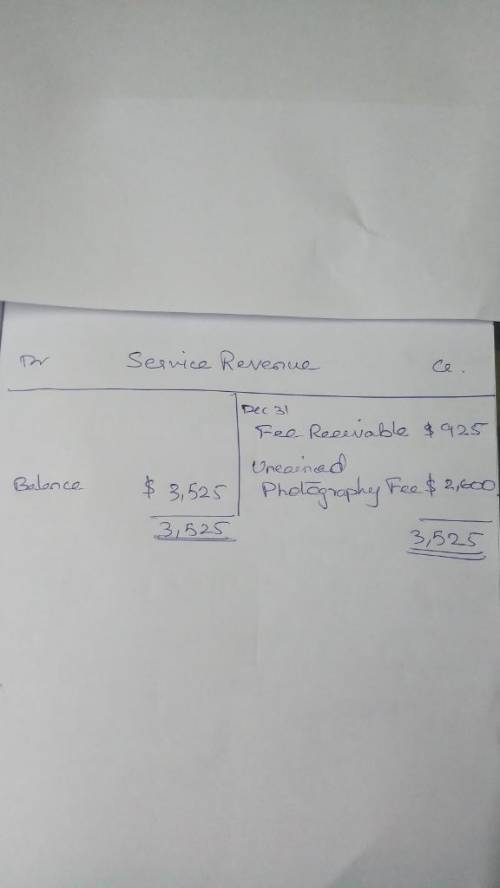

1. photography services of $925 have been rendered, but customers have not yet paid or beern billed. the firm uses the account fees receivable to reflect amounts due but not yet billed.

2. equipment, purchased january 1,2015, has an estimated life of 10 years.

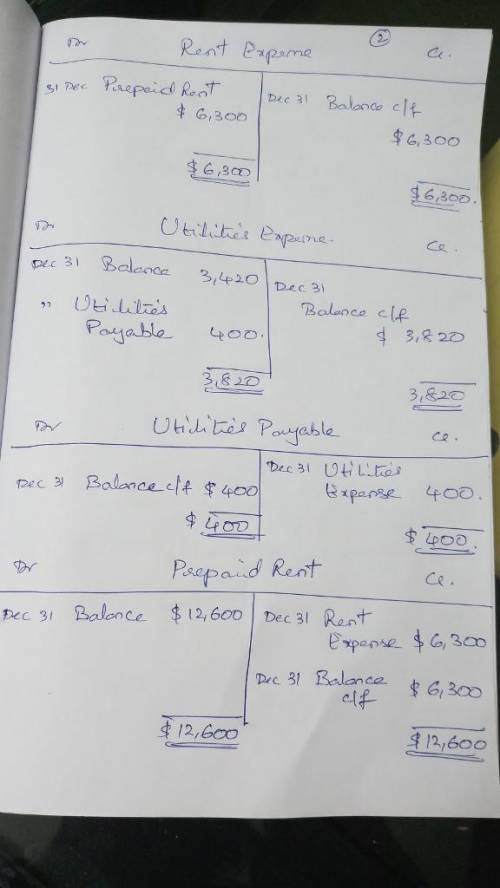

3. utilities expense for december is estimated to be $400, but the bill will not arrive or be paid until january of next year.

4. the balance in prepaid rent represents the amount paid on january 1,2015, for a 2-year lease on the studio.

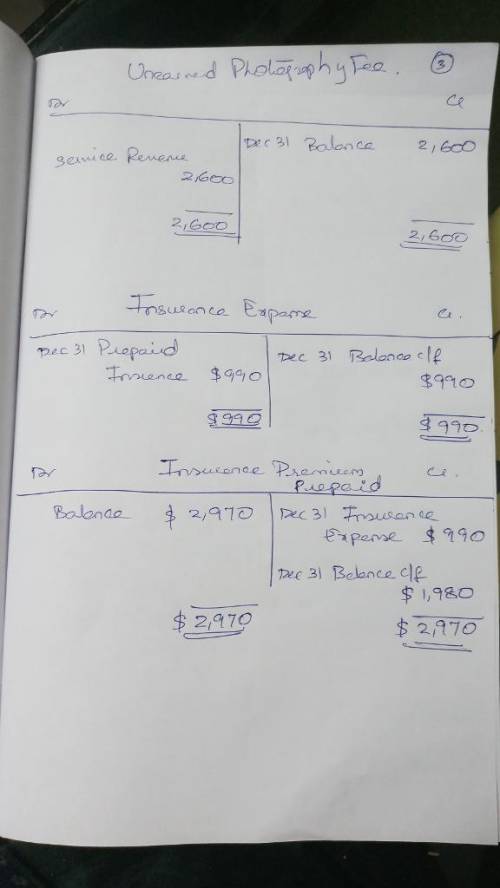

5. in november, customers paid $2,600 cash in advance for photos to be taken for the holiday season. when received, these fees were credited to unearned photography fees. by december 31, all of these fees are earned.

6. a 3-year insurance premium paid on january 1,2015, was debited to prepaid insurance.

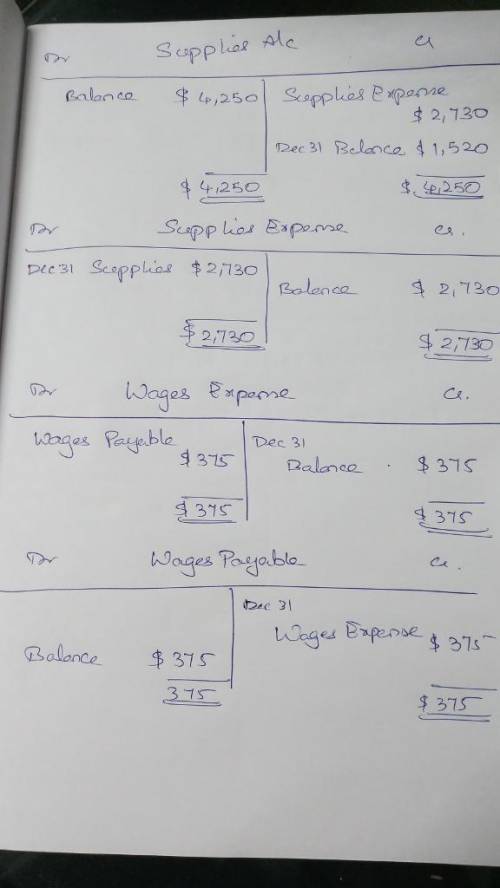

7. supplies available at december 31 are $1,520.

8. at december 31, wages expense of $375 has been incurred but not paid or recorded.

required:

a. prove that debits equal credits for snapshot's unadjusted account balances by preparing its unadjusted trial balance at december 31, 2015.

b. prepare its adjusting entries using the financial statement effects template.

c. prepare its adjusting entries in journal entry form.

d. set up t-accounts, enter the balances above, and post the adjusting entries to them.

Answers: 3

Another question on Business

Business, 22.06.2019 04:50

Harwood company uses a job-order costing system that applies overhead cost to jobs on the basis of machine-hours. the company's predetermined overhead rate of $2.50 per machine-hour was based on a cost formula that estimates $240,000 of total manufacturing overhead for an estimated activity level of 96,000 machine-hours. required: 1. assume that during the year the company works only 91,000 machine-hours and incurs the following costs in the manufacturing overhead and work in process accounts: compute the amount of overhead cost that would be applied to work in process for the year and make the entry in your t-accounts. 2a. compute the amount of underapplied or overapplied overhead for the year and show the balance in your manufacturing overhead t-account. 2b. prepare a journal entry to close the company's underapplied or overapplied overhead to cost of goods sold.

Answers: 1

Business, 22.06.2019 20:00

Ajax corp's sales last year were $435,000, its operating costs were $362,500, and its interest charges were $12,500. what was the firm's times-interest-earned (tie) ratio? a. 4.72b. 4.97c. 5.23d. 5.51e. 5.80

Answers: 1

Business, 22.06.2019 20:40

Owns a machine that can produce two specialized products. production time for product tlx is two units per hour and for product mtv is four units per hour. the machine’s capacity is 2,100 hours per year. both products are sold to a single customer who has agreed to buy all of the company’s output up to a maximum of 3,570 units of product tlx and 1,610 units of product mtv. selling prices and variable costs per unit to produce the products follow. product tlx product mtv selling price per unit $ 11.50 $ 6.90 variable costs per unit 3.45 4.14 determine the company's most profitable sales mix and the contribution margin that results from that sales mix.

Answers: 3

Business, 23.06.2019 02:30

What provides financial support to workers who are retired or have disabilities? medicare social security tax withholdings medicaid

Answers: 1

You know the right answer?

Snapshot company, a commercial photography studio, has just completed its first full year of operati...

Questions

Mathematics, 10.12.2020 02:30

Mathematics, 10.12.2020 02:30

Biology, 10.12.2020 02:30

Mathematics, 10.12.2020 02:30

English, 10.12.2020 02:30

Mathematics, 10.12.2020 02:30

Mathematics, 10.12.2020 02:30

Mathematics, 10.12.2020 02:30

Geography, 10.12.2020 02:30

Mathematics, 10.12.2020 02:30

Mathematics, 10.12.2020 02:30

Mathematics, 10.12.2020 02:30