Business, 11.02.2020 03:51 jacobmacalpine

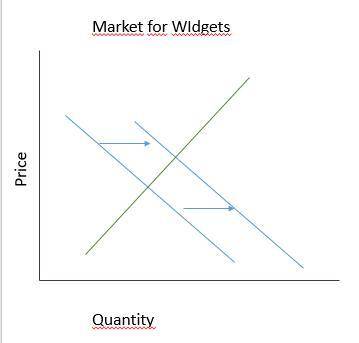

Suppose one of your friends offered the following argument: Market for Widgets A rightward shift in demand will cause an increase in p supply curve, which will lead to an offsetting decrease in price. Therefore, it is impossible to tell what effect an increase in demand will have on price rice. The increase in price will cause a rightward shift of the Do you agree with your friend? O A. Yes, any time both the supply and demand curves shift, it becomes impossible to accurately determine the impact on the price of a good B. No, the offsetting supply shift caused by the higher price will not be as large as the demand shift, so we know the a price will rise some C. No, the increase in pric e will not cause a shift of the supply curve D. Yes, since the shift in demand that raises the price must cause an offsetting shift in supply, we cannot know the impact on price Using the graph, show a shift in demand for widgets and how that shift in demand impacts the supply of widgets uantity (millions of boxes) 1.) Using the line drawing tool, depict an increase in demand for widgets. Label your curve D2 2.) Using either the line drawing tool or the single arrow drawing tool, depict the impact of the shift in demand on the supply for widgets. Either place an arrow showing how the quantity supplied changes along the supply curve, or draw a new supply curve to illustrate a shift in the entire supply curve Carefully follow the instructions above and only draw the required objects

Answers: 2

Another question on Business

Business, 22.06.2019 13:30

Hundreds of a bank's customers have called the customer service call center to complain that they are receiving text messages on their phone telling them to access a website and enter personal information to resolve an issue with their account. what action should the bank take?

Answers: 2

Business, 23.06.2019 00:00

Match each economic concept with the scenarios that illustrates it

Answers: 2

Business, 23.06.2019 02:00

Imprudential, inc., has an unfunded pension liability of $572 million that must be paid in 25 years. to assess the value of the firm’s stock, financial analysts want to discount this liability back to the present. if the relevant discount rate is 6.5 percent, what is the present value of this liability? (do not round intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89)

Answers: 3

Business, 23.06.2019 12:40

On january 1, a company issued and sold a $398,000, 6%, 10-year bond payable, and received proceeds of $393,000. interest is payable each june 30 and december 31. the company uses the straight-line method to amortize the discount. the journal entry to record the first interest payment is:

Answers: 2

You know the right answer?

Suppose one of your friends offered the following argument: Market for Widgets A rightward shift in...

Questions

English, 24.02.2021 18:50

Chemistry, 24.02.2021 18:50

Social Studies, 24.02.2021 18:50

Mathematics, 24.02.2021 18:50

Mathematics, 24.02.2021 18:50

Mathematics, 24.02.2021 18:50

Mathematics, 24.02.2021 18:50

Social Studies, 24.02.2021 18:50

Chemistry, 24.02.2021 18:50

Mathematics, 24.02.2021 18:50

Mathematics, 24.02.2021 18:50

Mathematics, 24.02.2021 18:50

Mathematics, 24.02.2021 18:50