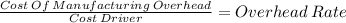

The Thomlin Company forecasts that total overhead for the current year will be $11,270,000 with 161,000 total machine hours. Year to date, the actual overhead is $7,987,000 and the actual machine hours are 85,000 hours. The predetermined overhead rate based on machine hours is Round the factory overhead rate to the nearest dollar before multiplying by the number of hours.

a. $3,342,000 overapplied

b. $2,228,000 underapplied

c. $2,228,000 overapplied

d. $3,342,000 underapplied

Answers: 2

Another question on Business

Business, 21.06.2019 16:50

New team of management has taken over. as a result, organizational changes from a country-club style leadership where everyone does whatever they want has changed to a more mechanistic, structured, top-down management style. what ethical issues should the employees consider and how should they go about addressing these?

Answers: 2

Business, 21.06.2019 18:10

Classifying inflows and outflows of cash classify each of the following items as an inflow (i) or an outflow (o) of cash, or as neither (n). lg 2 lg 2 item change ($) item change ($) cash +100 accounts receivable −700 accounts payable −1,000 net profits +600 notes payable +500 depreciation +100 long-term debt −2,000 repurchase of stock +600 inventory +200 cash dividends +800 fixed assets +400 sale of stock +1,000

Answers: 1

Business, 22.06.2019 19:00

The east asiatic company (eac), a danish company with subsidiaries throughout asia, has been funding its bangkok subsidiary primarily with u.s. dollar debt because of the cost and availability of dollar capital as opposed to thai baht-denominated (b) debt. the treasurer of eac-thailand is considering a 1-year bank loan for $247,000.the current spot rate is b32.03 /$, and the dollar-based interest is 6.78% for the 1-year period. 1-year loans are 12.04% in baht.a. assuming expected inflation rates of 4.3 % and 1.24% in thailand and the united states, respectively, for the coming year, according to purchase power parity, what would the effective cost of funds be in thai baht terms? b. if eac's foreign exchange advisers believe strongly that the thai government wants to push the value of the baht down against the dollar by5% over the coming year (to promote its export competitiveness in dollar markets), what might the effective cost of funds end up being in baht terms? c. if eac could borrow thai baht at 13% per annum, would this be cheaper than either part (a) or part (b) above?

Answers: 2

Business, 23.06.2019 02:00

How much more output does the $18 trillion u.s. economy produce when gdp increases by 3.0 percen?

Answers: 1

You know the right answer?

The Thomlin Company forecasts that total overhead for the current year will be $11,270,000 with 161,...

Questions

Mathematics, 08.10.2021 22:40

History, 08.10.2021 22:40

English, 08.10.2021 22:40

Mathematics, 08.10.2021 22:40

Mathematics, 08.10.2021 22:40

Computers and Technology, 08.10.2021 22:40

History, 08.10.2021 22:40

Mathematics, 08.10.2021 22:40

Mathematics, 08.10.2021 22:40

Mathematics, 08.10.2021 22:40

Mathematics, 08.10.2021 22:40