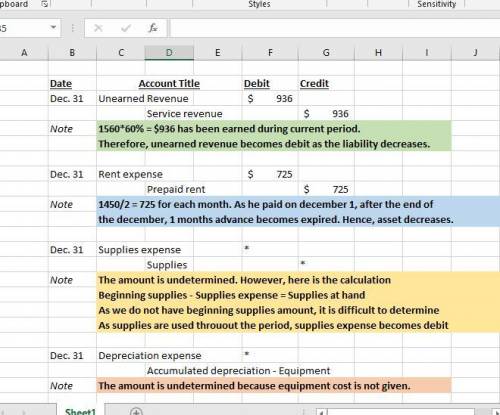

Complete the entries.12/31/2018-On December 15, Anniston contracted to perform services for a client and recorded the amount received as Unearned Revenue (amount $1,560). As of December 31, Anniston has earned 60% of this Unearned Revenue.

12/31/2018-Anniston prepaid two months of rent on December 1 ($1,450). This was debited to Prepaid Rent and is included in the Trial Balance.

12/31/2018 A physical count of supplies revealed an ending balance of $500.

12/31/2018 Anniston purchased the Equipment included on the Trial Balance on 12/1/16. The equipment has a residual value of $1,000 and is expected to last a total of 10 years. Anniston last recorded depreciation of this equipment on 12/31/17.

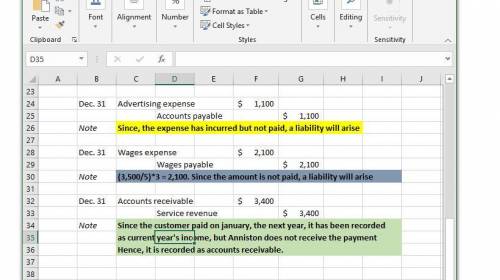

12/31/2018 Anniston received a bill for December's online advertising, $1,100. Anniston will not pay the bill until January (Anniston uses Accounts Payable for unpaid advertising).

12/31/2018Anniston pays its employees on Monday for the previous week's wages. Its employees earn $3,500 for the five-day workweek. December 31 falls on a Wednesday this year.

12/31/2018 On October 1, Anniston agreed to provide a four-month air system check beginning that day. The customer agreed to pay a total of $3,400 at the end of the four month service contract. As of December 31, Anniston has completed all work as necessary, but has not recorded any revenue to date.

Answers: 1

Another question on Business

Business, 21.06.2019 23:30

Which type of market are you in if your company, along with three other companies, controls 95 percent of the total music industry?

Answers: 3

Business, 22.06.2019 06:10

Information on gerken power co., is shown below. assume the company’s tax rate is 40 percent. debt: 9,400 8.4 percent coupon bonds outstanding, $1,000 par value, 21 years to maturity, selling for 100.5 percent of par; the bonds make semiannual payments. common stock: 219,000 shares outstanding, selling for $83.90 per share; beta is 1.24. preferred stock: 12,900 shares of 5.95 percent preferred stock outstanding, currently selling for $97.10 per share. market: 7.2 percent market risk premium and 5 percent risk-free rate. required: calculate the company's wacc. (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) wacc %

Answers: 2

Business, 22.06.2019 15:30

Calculate the required rate of return for climax inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. do not round your intermediate calculations.

Answers: 3

Business, 22.06.2019 20:00

Ajax corp's sales last year were $435,000, its operating costs were $362,500, and its interest charges were $12,500. what was the firm's times-interest-earned (tie) ratio? a. 4.72b. 4.97c. 5.23d. 5.51e. 5.80

Answers: 1

You know the right answer?

Complete the entries.12/31/2018-On December 15, Anniston contracted to perform services for a client...

Questions

Social Studies, 21.10.2019 21:00

Mathematics, 21.10.2019 21:00

Mathematics, 21.10.2019 21:00

Social Studies, 21.10.2019 21:00

Mathematics, 21.10.2019 21:00

Arts, 21.10.2019 21:00

Geography, 21.10.2019 21:00

English, 21.10.2019 21:00