Business, 14.02.2020 04:16 krazziekidd2p845ri

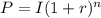

Microsoft stock price peaked at 6118% of its IPO price more than 13 years after the IPO† Suppose that $15,000 invested in Microsoft at its IPO price had been worth $900,000 (6000% of the IPO price) after exactly 13 years. What interest rate, compounded annually, does this represent?

Answers: 2

Another question on Business

Business, 22.06.2019 05:50

Emily spent her summer vacation in buenos aires, argentina, where she got plastic surgery for a fraction of what it would cost in the united states. this is an example of:

Answers: 2

Business, 22.06.2019 12:40

Kumar consulting operates several stock investment portfolios that are used by firms for investment of pension plan assets. last year, one portfolio had a realized return of 12.6 percent and a beta coefficient of 1.15. the average t-bond rate was 7 percent and the realized rate of return on the s& p 500 was 12 percent. what was the portfolio's alpha?

Answers: 1

Business, 22.06.2019 14:30

Turtle corporation produces and sells a single product. data concerning that product appear below: per unit percent of sales selling price $ 150 100 % variable expenses 75 50 % contribution margin $ 75 50 % the company is currently selling 5,600 units per month. fixed expenses are $194,000 per month. the marketing manager believes that a $5,300 increase in the monthly advertising budget would result in a 190 unit increase in monthly sales. what should be the overall effect on the company's monthly net operating income of this change?

Answers: 1

Business, 22.06.2019 17:30

Google started as one of many internet search engines, amazon started as an online book seller, and ebay began as a site where people could sell used personal items in auctions. these firms have grown to be so large and dominant that they are facing antitrust scrutiny from competition regulators in the us and elsewhere. did these online giants grow by fairly beating competition, or did they use unfair advantages? are there any clouds on the horizon for these firms -- could they face diseconomies of scale or diseconomies of scope as they continue to grow? if so, what factors may limit their continued growth?

Answers: 1

You know the right answer?

Microsoft stock price peaked at 6118% of its IPO price more than 13 years after the IPO† Suppose tha...

Questions

Biology, 06.11.2019 20:31

Mathematics, 06.11.2019 20:31

Biology, 06.11.2019 20:31

English, 06.11.2019 20:31

Health, 06.11.2019 20:31

SAT, 06.11.2019 20:31

Mathematics, 06.11.2019 20:31

History, 06.11.2019 20:31

Spanish, 06.11.2019 20:31

Spanish, 06.11.2019 20:31

Geography, 06.11.2019 20:31

Mathematics, 06.11.2019 20:31