Business, 14.02.2020 06:08 kcarstensen59070

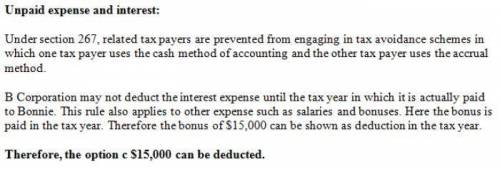

B Corporation, an accrual basis taxpayer, is owned 75 percent by Bonnie, a cash basis taxpayer. On December 31, 20X1, the corporation accrues interest of $4,000 on a loan from Bonnie and also accrues a $15,000 bonus to Bonnie. The bonus is paid to Bonnie on March 1, 20X2; the interest is not paid until 20X3. How much can B Corporation deduct on its 20X2 tax return?a. $0b. $4,000c. $15,000d. $19,000e. $12,00

Answers: 2

Another question on Business

Business, 22.06.2019 15:00

1. list five staple convenience goods that you or your household buys on a regular basis. (you do not need to use complete sentences. 2.5 points) 2. list three impulse convenience goods that you or someone you know has purchased. (you do not need to use complete sentences. 2.5 points) 3. describe a shopping good that you or someone you know purchased. what kind of research did you or that person do before buying the product? (1-5 sentences. 3.0 points) 4. choose an example of a company you could start, and decide which business structure would make the most sense for that type of company (sole proprietorship, partnership, llc, c corporation, s corporation, or nonprofit corporation). explain why this structure would be good for this type of company. give at least 3 reasons. (3-6 sentences. 6.0 points) 5. if you were starting a new business, describe at least three departments to the company that you would need right away. why are these departments so important? (1-5 sentences. 3.0 points) 6. describe a product that you think has saturated its market. what makes you think it has saturated its market? (1-5 sentences. 3.0 points)

Answers: 2

Business, 22.06.2019 23:10

Until recently, hamburgers at the city sports arena cost $4.70 each. the food concessionaire sold an average of 13 comma 000 hamburgers on game night. when the price was raised to $5.40, hamburger sales dropped off to an average of 6 comma 000 per night. (a) assuming a linear demand curve, find the price of a hamburger that will maximize the nightly hamburger revenue. (b) if the concessionaire had fixed costs of $1 comma 500 per night and the variable cost is $0.60 per hamburger, find the price of a hamburger that will maximize the nightly hamburger profit.

Answers: 1

Business, 22.06.2019 23:10

The direct labor budget of yuvwell corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours: 1st quarter 2nd quarter 3rd quarter 4th quarterbudgeted direct labor-hours 11,200 9,800 10,100 10,900the company uses direct labor-hours as its overhead allocation base. the variable portion of its predetermined manufacturing overhead rate is $6.00 per direct labor-hour and its total fixed manufacturing overhead is $80,000 per quarter. the only noncash item included in fixed manufacturing overhead is depreciation, which is $20,000 per quarter.required: 1. prepare the company’s manufacturing overhead budget for the upcoming fiscal year.2. compute the company’s predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year.

Answers: 3

Business, 23.06.2019 00:30

Greentel, a telecom giant, has been using the service of orpheus inc. for training its employees. according to a deal signed by the two companies, orpheus inc. is not only responsible for training greentel's employees but also for providing comprehensive administrative services to the telecom giant. in this instance, greentel engages in

Answers: 1

You know the right answer?

B Corporation, an accrual basis taxpayer, is owned 75 percent by Bonnie, a cash basis taxpayer. On D...

Questions

Biology, 19.02.2020 04:03

English, 19.02.2020 04:03

Chemistry, 19.02.2020 04:03

English, 19.02.2020 04:03

Mathematics, 19.02.2020 04:03

Mathematics, 19.02.2020 04:03

Mathematics, 19.02.2020 04:05

Mathematics, 19.02.2020 04:09

History, 19.02.2020 04:09

Mathematics, 19.02.2020 04:11