Business, 14.02.2020 20:52 cheycheybabygirl01

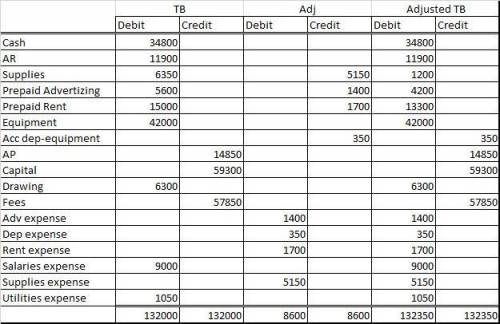

Supplies were purchased on January 1, 2019; inventory of supplies on January 31, 2019, is $1,200. The prepaid advertising contract was signed on January 1, 2019, and covers a four-month period. Rent of $1,700 expired during the month. Depreciation is computed using the straight-line method. The equipment has an estimated useful life of 10 years with no salvage value.

a. Complete the worksheet for the month.

b. Prepare an income statement, statement of owner’s equity, and balance sheet. No additional investments were made by the owner during the month.

c. Journalize and post the adjusting entries.

d. If the adjusting entries had not been made for the month, would the net income be overstated or understated?

Answers: 2

Another question on Business

Business, 22.06.2019 16:20

Stosch company's balance sheet reported assets of $112,000, liabilities of $29,000 and common stock of $26,000 as of december 31, year 1. if retained earnings on the balance sheet as of december 31, year 2, amount to $74,000 and stosch paid a $28,000 dividend during year 2, then the amount of net income for year 2 was which of the following? a)$23,000 b) $35,000 c) $12,000 d)$42,000

Answers: 1

Business, 22.06.2019 17:30

You should do all of the following before a job interview except

Answers: 2

Business, 22.06.2019 21:00

Dozier company produced and sold 1,000 units during its first month of operations. it reported the following costs and expenses for the month: direct materials $ 69,000 direct labor $ 35,000 variable manufacturing overhead $ 15,000 fixed manufacturing overhead 28,000 total manufacturing overhead $ 43,000 variable selling expense $ 12,000 fixed selling expense 18,000 total selling expense $ 30,000 variable administrative expense $ 4,000 fixed administrative expense 25,000 total administrative expense $ 29,000 required: 1. with respect to cost classifications for preparing financial statements: a. what is the total product cost

Answers: 2

You know the right answer?

Supplies were purchased on January 1, 2019; inventory of supplies on January 31, 2019, is $1,200. Th...

Questions

Mathematics, 29.09.2019 06:00

Health, 29.09.2019 06:00

Mathematics, 29.09.2019 06:00

Mathematics, 29.09.2019 06:00

History, 29.09.2019 06:00

History, 29.09.2019 06:00

Mathematics, 29.09.2019 06:00

Biology, 29.09.2019 06:00

Chemistry, 29.09.2019 06:00

History, 29.09.2019 06:00

Biology, 29.09.2019 06:00

Spanish, 29.09.2019 06:00

Biology, 29.09.2019 06:00