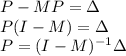

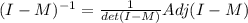

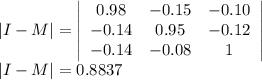

1. An economy has three sectors producing products Product 1, Product 2, and Prod- uct 3. • To produce 1 unit of Product 1 requires 0.20 units of Product 1, 0.15 units of Product 2, and 0.10 units of Product 3. • To product 1 unit of Product 2 it takes 0.14 units of Product 1, 0.05 units of Product 2, and 0.12 units of Product 3. • To produce 1 unit of Product 3 it takes 0.14 units of Product 1, and 0.08 units of Product 2. (a) What should the total production be set at in order to satisfy an external de- mand of 100 units of Product 1, 120 units of Product 2, and 150 units of Product 3? (b) Individually interpret each entry in the third column of (I − M)−1.

Answers: 1

Another question on Business

Business, 20.06.2019 18:04

The text states that the committee “expects inflation to rise gradually toward 2% over the medium term as the labor market improves further….” why would the fomc expect inflation to rise because of improvements in the labor market?

Answers: 1

Business, 21.06.2019 20:30

Which of the following best describes how the federal reserve bank banks during a bank run? a. the federal reserve bank has the power to take over a private bank if customers demand too many withdrawals. b. the federal reserve bank can provide a short-term loan to banks to prevent them from running out of money. c. the federal reserve bank regulates exchanges to prevent the demand for withdrawals from rising above the required reserve ratio. d. the federal reserve bank acts as an insurance company that pays customers if their bank fails. 2b2t

Answers: 3

Business, 22.06.2019 02:10

The federal reserve's organization while all members of the federal reserve board of governors vote at federal open market committee (fomc) meetings, only of the regional bank presidents are members of the fomc. the federal reserve's role as a lender of last resort involves lending to which of the following financially troubled institutions? u.s. banks that cannot borrow elsewhere governments in developing countries during currency crises u.s. state governments when they run short on tax revenues the federal reserve's primary tool for changing the money supply is . in order to decrease the number of dollars in the u.s. economy (the money supply), the federal reserve will government bonds.

Answers: 1

Business, 22.06.2019 08:20

Which change is illustrated by the shift taking place on this graph? a decrease in supply an increase in supply o an increase in demand o a decrease in demand

Answers: 3

You know the right answer?

1. An economy has three sectors producing products Product 1, Product 2, and Prod- uct 3. • To produ...

Questions

Chemistry, 29.06.2021 18:00

History, 29.06.2021 18:00

Mathematics, 29.06.2021 18:00

Biology, 29.06.2021 18:00

Mathematics, 29.06.2021 18:00

French, 29.06.2021 18:00

Mathematics, 29.06.2021 18:00

Mathematics, 29.06.2021 18:00

History, 29.06.2021 18:00

Physics, 29.06.2021 18:00

![\left[\begin{array}{c}P_1\\P_2\\P_3\end{array}\right] =\left[\begin{array}{ccc}0.02&.0.15&0.10\\0.14&0.05&0.12\\0.14&0.08&0\end{array}\right] \left[\begin{array}{c}P_1\\P_2\\P_3\end{array}\right] +\left[\begin{array}{c}P_1\\P_2\\P_3\end{array}\right] _{external}](/tpl/images/0512/0177/6d45c.png)

![\left[\begin{array}{c}P_1\\P_2\\P_3\end{array}\right] _{external}=\left[\begin{array}{c}100\\120\\150\end{array}\right]](/tpl/images/0512/0177/b2b35.png)

![\left[\begin{array}{c}P_1\\P_2\\P_3\end{array}\right] =\left[\begin{array}{ccc}0.02&.0.15&0.10\\0.14&0.05&0.12\\0.14&0.08&0\end{array}\right] \left[\begin{array}{c}P_1\\P_2\\P_3\end{array}\right] +\left[\begin{array}{c}100\\120\\150\end{array}\right]](/tpl/images/0512/0177/c888a.png)

![P=\left[\begin{array}{c}P_1\\P_2\\P_3\end{array}\right] \\M=\left[\begin{array}{ccc}0.02&.0.15&0.10\\0.14&0.05&0.12\\0.14&0.08&0\end{array}\right] \\\Delta=\left[\begin{array}{c}100\\120\\150\end{array}\right]](/tpl/images/0512/0177/b7a9b.png)

![\\I-M=\left[\begin{array}{ccc}1&0&0\\0&1&0\\0&0&1\end{array}\right] -\left[\begin{array}{ccc}0.02&0.15&0.10\\0.14&0.05&0.12\\0.14&0.08&0\end{array}\right] \\ I-M=\left[\begin{array}{ccc}1-0.02&0-0.15&0-0.10\\0-0.14&1-0.05&0-0.12\\0-0.14&0-0.08&1-0\end{array}\right] \\I-M=\left[\begin{array}{ccc}0.98&-0.15&-0.10\\-0.14&0.95&-0.12\\-0.14&-0.08&1\end{array}\right]](/tpl/images/0512/0177/61845.png)

![adj(I-M)=adj(\left[\begin{array}{ccc}0.98&-0.15&-0.10\\-0.14&0.95&-0.12\\-0.14&-0.08&1\end{array}\right])\\adj(I-M)=\left[\begin{array}{ccc}0.9404&0.1580 & 0.1130\\0.1568&0.9660& 0.1316\\0.1442 &0.0994 & 0.9100\end{array}\right]\\](/tpl/images/0512/0177/cfc6b.png)

![(I-M)^{-1}=\frac{1}{0.8837}\left[\begin{array}{ccc}0.9404&0.1580 & 0.1130\\0.1568&0.9660& 0.1316\\0.1442 &0.0994 & 0.9100\end{array}\right]\\\\(I-M)^{-1}=\left[\begin{array}{ccc}1.0642 & 0.1788 & 0.1279\\ 0.1774 &1.0932 & 0.1489\\ 0.1632 & 0.1125 & 1.0298\end{array}\right]\\](/tpl/images/0512/0177/17675.png)

![\left[\begin{array}{c}P_1\\P_2\\P_3\end{array}\right]=\left[\begin{array}{ccc}1.0642 & 0.1788 & 0.1279\\ 0.1774 &1.0932 & 0.1489\\ 0.1632 & 0.1125 & 1.0298\end{array}\right]\left[\begin{array}{c}100\\120\\150\end{array}\right]\\\\\left[\begin{array}{c}P_1\\P_2\\P_3\end{array}\right]=\left[\begin{array}{c}147.06\\ 171.27 \\184.29\end{array}\right]\\](/tpl/images/0512/0177/d6af0.png)