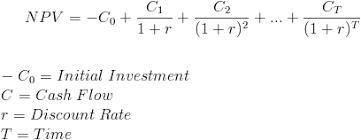

4 . Net present value method Ewing Corporation is evaluating a proposed capital budgeting project that will require an initial investment of $136,000. The project is expected to generate the following net cash flows: Year Cash Flow 1 $40,000 2 $50,900 3 $46,200 4 $43,900 Assume the desired rate of return on a project of this type is 9%. The net present value of this project is Suppose Ewing Corporation has enough capital to fund the project, and the project is not competing for funding with other projects. Should Ewing Corporation accept or reject this project? Reject the project Accept the project

Answers: 2

Another question on Business

Business, 22.06.2019 14:00

How many months does the federal budget usually take to prepare

Answers: 1

Business, 22.06.2019 22:00

The company is experiencing an increase in competition, and at the same time they are building more production facilities in southeast asia. in this scenario, the top management team is most likely to multiple choice increase the cost of their products. restructure to reflect a more bureaucratic, stable organization. pull decision-making responsibility from low-level management, taking it on themselves. give lower-level managers the authority to make decisions to benefit the firm. rid themselves of all buffering product.

Answers: 3

Business, 23.06.2019 02:20

Which one of the following is not a typical current liability? a. interest payable b. current maturities of long-term debt c. salaries payable d. mortgages payable

Answers: 3

Business, 23.06.2019 13:30

Cvp analysis, shoe stores. the highstep shoe company operates a chain of shoe stores that sell 10 different styles of inexpensive men's shoes with identical unit costs and selling prices. a unit is defined as a pair of shoes. each store has a store manager who is paid a fixed salary. individual salespeople receive a fixed salary and a sales commission. highstep is considering opening another store that is expected to have the revenue and cost relationships shown here.

Answers: 2

You know the right answer?

4 . Net present value method Ewing Corporation is evaluating a proposed capital budgeting project th...

Questions

Mathematics, 18.11.2019 13:31

English, 18.11.2019 13:31

History, 18.11.2019 13:31

Mathematics, 18.11.2019 13:31

Mathematics, 18.11.2019 13:31

English, 18.11.2019 13:31

Mathematics, 18.11.2019 13:31

Mathematics, 18.11.2019 13:31

English, 18.11.2019 13:31

Mathematics, 18.11.2019 13:31