Business, 18.02.2020 03:17 zmirandalove100

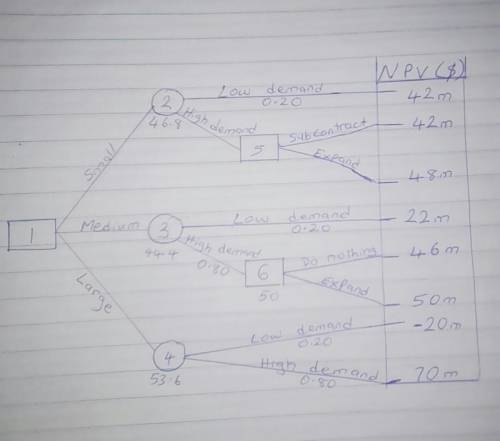

A firm must decide whether to construct a small, medium, or large stamping plant. A consultant’s report indicates a .20 probability that demand will be low and an .80 probability that demand will be high. If the firm builds a small facility and demand turns out to be low, the net present value will be $42 million. If demand turns out to be high, the firm can either subcontract and realize the net present value of $42 million or expand greatly for a net present value of $48 million. The firm could build a medium-size facility as a hedge: If demand turns out to be low, its net present value is estimated at $22 million; if demand turns out to be high, the firm could do nothing and realize a net present value of $46 million, or it could expand and realize a net present value of $50 million. If the firm builds a large facility and demand is low, the net present value will be −$20 million, whereas high demand will result in a net present value of $72 million. b. What is the maximin alternative? (Negative amount should be indicated by a minus sign. Omit the "$" sign in your response.)

Answers: 1

Another question on Business

Business, 22.06.2019 02:30

The cost of capital: introduction the cost of capital: introduction companies issue bonds, preferred stock, and common equity to aise capital to invest in capital budgeting projects. capital is』necessary factor of production and like any other factor, it has a cost. this cost is equal to the select the applicable security. the rates of return that investors require on bonds, preferred stocks, and common equity represent the costs of those securities to the firm. companies estimate the required returns on their securities, calculate a weighted average of the costs of their different types of capital, and use this average cost for capital budgeting purposes. required return on rate: when calculating om operations when the firm's primary financial objective is to select shareholder value. to do this, companies invest in projects that earnselect their cost of capital. so, the cost of capital is often referred to as the -select -select and accruals, which a se spontaneously we hted average cost of capital wa c our concern is with capital that must be provided by select- 쑤 interest-bearing debt preferred stock and common equity. capital budgeting projects are undertaken, are not included as part of total invested capital because they do not come directly from investors. which of the following would be included in the caculation of total invested capital? choose the response that is most correct a. notes payable b. taxes payable c retained earnings d. responses a and c would be included in the calculation of total invested capital. e. none of the above would be included in the cakulation of total invested capital.

Answers: 2

Business, 22.06.2019 09:50

phillips, inc. had the following financial data for the year ended december 31, 2019. cash $ 41,000 cash equivalents 75,000 long term investments 59,000 total current liabilities 149,000 what is the cash ratio as of december 31, 2019, for phillips, inc.? (round your answer to two decimal places.)

Answers: 3

Business, 22.06.2019 11:00

What is the advantage of developing criteria for assessing the effectiveness of business products and processes? a. assessment criteria are answers. b.assessment criteria are inexpensive. c.assessment criteria provide you with a list of relevant things to measure. d.assessment criteria provide you with a list of people to contact to learn more about process mentoring.

Answers: 3

Business, 22.06.2019 20:00

Suppose a country's productivity last year was 84. if this country's productivity growth rate of 5 percent is to be maintained, this means that this year's productivity will have to be:

Answers: 2

You know the right answer?

A firm must decide whether to construct a small, medium, or large stamping plant. A consultant’s rep...

Questions

English, 10.05.2021 18:00

Physics, 10.05.2021 18:00

English, 10.05.2021 18:00

Mathematics, 10.05.2021 18:00

Mathematics, 10.05.2021 18:00

Mathematics, 10.05.2021 18:00

Mathematics, 10.05.2021 18:00

History, 10.05.2021 18:00

Mathematics, 10.05.2021 18:00