Business, 18.02.2020 06:05 RafMad5018

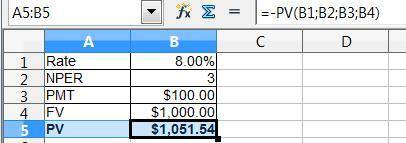

A 3-year bond with 10% coupon rate and $1000 face value yields 8%. Assuming annual coupon payment, calculate the price of the bond.

Answers: 2

Another question on Business

Business, 21.06.2019 16:50

The bonds issued by the south foot bear a coupon rate of 7.5 percent, payable semiannually. the bonds mature in 6.5 years, sell at par, and have a $1,000 face value. what is the yield to maturity

Answers: 3

Business, 22.06.2019 19:00

The following are budgeted data: january february march sales in units 16,200 22,400 19,200 production in units 19,200 20,200 18,700 one pound of material is required for each finished unit. the inventory of materials at the end of each month should equal 20% of the following month's production needs. purchases of raw materials for february would be budgeted to be:

Answers: 3

Business, 22.06.2019 19:00

Lucy is catering an important luncheon and wants to make sure her bisque has the perfect consistency. for her bisque to turn out right, it should have the consistency of a. cold heavy cream. b. warm milk. c. foie gras. d. thick oatmeal.

Answers: 3

You know the right answer?

A 3-year bond with 10% coupon rate and $1000 face value yields 8%. Assuming annual coupon payment, c...

Questions

History, 01.02.2020 03:45

Mathematics, 01.02.2020 03:45

Mathematics, 01.02.2020 03:45

Mathematics, 01.02.2020 03:45

Mathematics, 01.02.2020 03:45

History, 01.02.2020 03:45

Chemistry, 01.02.2020 03:45

History, 01.02.2020 03:45