Business, 18.02.2020 22:32 karebareyo

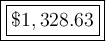

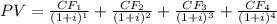

Many financial decisions require the analysis of uneven, or nonconstant: cash flows stock dividends typically increase over time and investments in capital equipment almost always generate uneven cash flows. The term cash flow (CFt) denotes cash flows, while payment (PMT) designates cash flows coming at regular intervals The present value of an uneven cash flow stream is the sum of the PVs of the individual cash flows. The equation is: PV = Similarly, the future value of an uneven cash flow stream is the sum of the FVs of the individual cash flows. Many calculators have an NFV key that lets you obtain the FV. However, if your calculator doesn't have a net future value (NFV) key, you can calculate the NFV as follows: NFV-NPV × (1+1) One can also find the interest rate of the uneven cash flow stream with a financial calculator and solving Quantitative Problem: You own a security with the cash flows shown below 700 355 240 320 If you equire an annual retum of 10%, what is the present value of this cash flow stream? Round your answer to the nearest cent. Do not round intermediate calculations.

Answers: 1

Another question on Business

Business, 22.06.2019 11:10

Your team has identified the risks on the project and determined their risk score. the team is in the midst of determining what strategies to put in place should the risks occur. after some discussion, the team members have determined that the risk of losing their network administrator is a risk they'll just deal with if and when it occurs. although they think it's a possibility and the impact would be significant, they've decided to simply deal with it after the fact. which of the following is true regarding this question? a. this is a positive response strategy.b. this is a negative response strategy.c. this is a response strategy for either positive or negative risk known as contingency planning.d. this is a response strategy for either positive or negative risks known as passive acceptance.

Answers: 2

Business, 22.06.2019 14:00

Bayside coatings company purchased waterproofing equipment on january 2, 20y4, for $190,000. the equipment was expected to have a useful life of four years and a residual value of $9,000. instructions: determine the amount of depreciation expense for the years ended december 31, 20y4, 20y5, 20y6, and 20y7, by (a) the straight-line method and (b) the double-declining-balance method. also determine the total depreciation expense for the four years by each method. depreciation expense year straight-line method double-declining-balance method 20y4 $ $ 20y5 20y6 20y7 total $

Answers: 3

Business, 22.06.2019 23:30

At the save the fish nonprofit organization, jenna is responsible for authorizing outgoing payments, rob takes care of recording the payments in the organization's computerized accounting system, and shannon reconciles the organization's bank statements each month. this internal accounting control is best known as a(n) a. distribution process. b. segregation of duties c. specialized budget d. annotated financial process

Answers: 2

Business, 23.06.2019 01:30

Why would adjusting the money supply be expected to increase economic growth during a recession? a) increasing the money supply will encourage more saving. b) increased money supply will encourage more spending and investment. co) decreased money supply will encourage more spending and investment. d) recession is caused by too much

Answers: 3

You know the right answer?

Many financial decisions require the analysis of uneven, or nonconstant: cash flows stock dividends...

Questions

Mathematics, 06.07.2021 18:30

Mathematics, 06.07.2021 18:30

English, 06.07.2021 18:30

Computers and Technology, 06.07.2021 18:30

Computers and Technology, 06.07.2021 18:30

Computers and Technology, 06.07.2021 18:30